Executions traders will be increasingly responsible for configuring, deploying and overseeing their virtual colleagues. Regular check-ins are important to ensure automation rules are properly configured to optimize the objective of the trading desk and adjustments are made where necessary.

– Ravi Sawhney, Head of Automation and Analytics, Bloomberg LP

Greater automation will likely require that traders have a greater understanding of how these tools work and how changing the settings and criteria impact the outcomes. Traders will also need to work more closely with venues as they develop new products, so they meet their individual needs.

– Alex Sedgwick, Market Structure and Electronic Trading Consultant, Fincisive Strategies

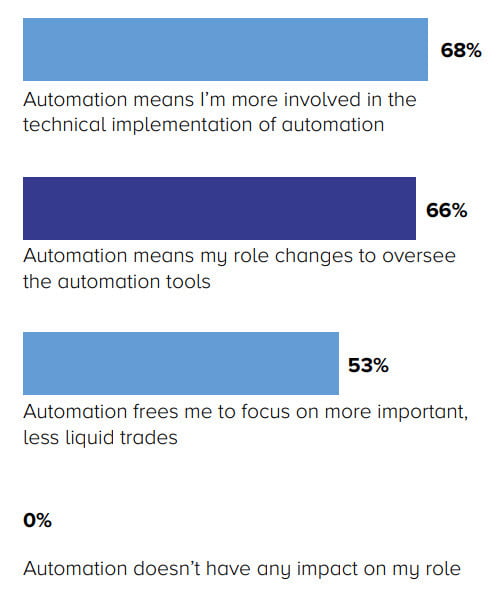

Respondents were asked to select all that apply

With increasing pressure on costs, the buy option is looking much more attractive. Building new technology can be tempting, but the cost of continuous maintenance and development can be crushing. To the extent you can mutualize these costs across the industry and still get what you need, buying is the preferred option.

– Alex Sedgwick, Market Structure and Electronic Trading Consultant, Fincisive Strategies

The data suggests that firms are primarily focused on their core competencies related to trading. This opens up an opportunity for technology providers to create strong partnerships with buy-side desks. The most successful technology partners will understand a desk’s business needs so they can provide best-in-class solutions that are robust, wellsupported, and easy to integrate into existing platforms and processes.

– Tracy Rucker-Wilson, Global Portfolio Risk Manager – Fixed Income, Vanguard

Advanced firms are creating very nuanced rules for their automation strategies that reflect the specific fixed income product being traded, such as for a USD HY credit versus a short-end EM bond. Tools such as Bloomberg’s Rule Builder can do this effectively by leveraging vast data sets for instrument definitions along with liquidity scoring products and real-time composites.

– Ravi Sawhney, Head of Automation and Analytics, Bloomberg LP

Order routing is the obvious answer, but I think it is important to note the emphasis on execution criteria. In many fixed income markets, particularly where prices may gap, it is critical to include execution criteria to ensure you don’t trade based on an off-market quote or price.

– Alex Sedgwick, Market Structure and Electronic Trading Consultant, Fincisive Strategies

The ability to efficiently route and execute orders is a critical function for any trading desk, second in importance to hiring the right people on your team to handle the increasingly complex market and regulatory environment.

– Tracy Rucker-Wilson, Global Portfolio Risk Manager – Fixed Income, Vanguard