The experience with equities is a useful starting point - but as the responses indicate, fixedincome traders have a different set of needs which can also vary between liquid products like treasuries and less liquid corporate bonds. We are still early in the process of introducing automation to this market, so you’ll see the products adapt and evolve.

– Alex Sedgwick, Market Structure and Electronic Trading Consultant, Fincisive Strategies

The problem with borrowing automation tools from equities is that fixed income is much more illiquid and fragmented, and trades are usually more complex. Newer tech entrants to the space are creating more tailored solutions to address this.

– Lauren Harrison, Conference Director, Fixed Income Leaders

These responses capture the problems we’ve seen in other markets. When you consider automating trades you need to make a business case, test the new execution method and validate that you are not sacrificing best execution for operational efficiency. However, you’ll also need to commit on an ongoing basis to continuously monitoring your execution quality to identify unexpected outcomes and adjust accordingly.

– Alex Sedgwick, Market Structure and Electronic Trading Consultant, Fincisive Strategies

It will be crucial to understand and test the criteria used to determine which trades should be automated. In addition, the system should incorporate fail-safe procedures to ensure that if errors do occur, they can be greatly minimized. Reporting and analysis on a post-trade basis is necessary to continuously improve the automation process.

– Alvin Burgos, Independent Expert

The initial concern with automation was the implication of unemployment. The industry is moving away from this now, people are less afraid of automation, and they’re focusing on how to get it right. It’s key that firms find the balance between high and low touch trading, and make sure they have enough people on the desk conducting more complex trades while automation handles the simpler trades.

– Lauren Harrison, Conference Director, Fixed Income Leaders

Firms need to create a policy on how to approach automation for the trading desk. Elements of this policy will include, for example, assigning who can create rules, having monitoring tools in place and under what conditions to suspend automation. It is vital that traders feel they are in control of automation.

– Ravi Sawhney, Head of Automation and Analytics, Bloomberg LP

There are three elements to mitigating automation risks: monitoring, robust processes and a strong governance regime. Governance often receives less emphasis than it should - metrics related to performance and oversight of automation should be regularly reviewed by trading management to ensure no changes are needed.

– Alex Sedgwick, Market Structure and Electronic Trading Consultant, Fincisive Strategies

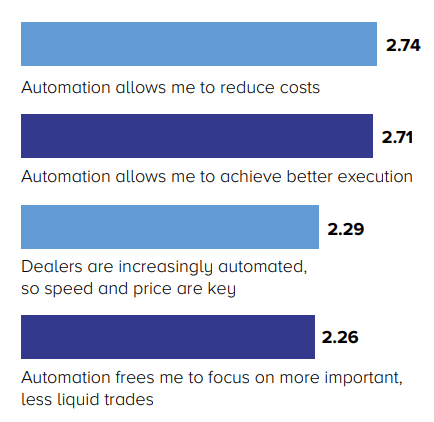

Achieving a reduction in the cost base of a trading desk, is perhaps unsurprisingly, the biggest driver for automation. However, we are seeing this more as the re-deployment of trader time to tasks that can actually deliver more value to the desk, as opposed to the elimination of the role altogether.

– Ravi Sawhney, Head of Automation and Analytics, Bloomberg LP

It is great to see that cost reduction and best execution are linked in these responses. Ultimately, the cost reductions from innovation should benefit the end client rather than just the manager - and you see evidence of that view in the results.

– Alex Sedgwick, Market Structure and Electronic Trading Consultant, Fincisive Strategies

Respondents were asked to rank options from 1-4, 1 being the most important driver

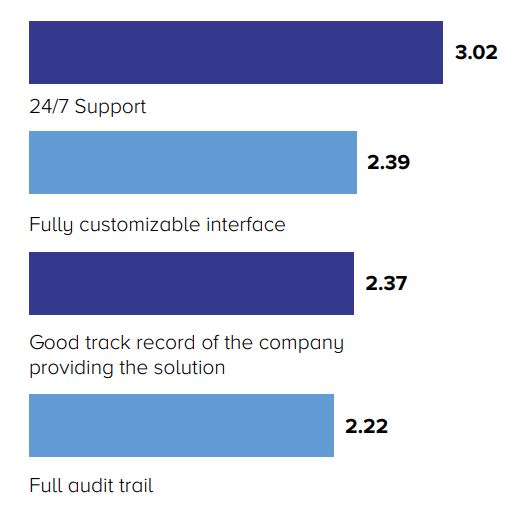

As platforms take on more direct responsibility for executing an order they will need stronger internal controls and error resolution policies. Most importantly, if something does go wrong, you need to know that there will be someone to address the issue immediately.

– Alex Sedgwick, Market Structure and Electronic Trading Consultant, Fincisive Strategies

Respondents were asked to rank options from 1-4, 1 being the most important