Portfolio managers have found themselves in a highly cost-pressured environment, meaning they have to take more risks to generate more money. As a result, mitigating risk is front-ofmind, and firms are starting to explore new routes for this.

– Lauren Harrison, Conference Director, Fixed Income Leaders

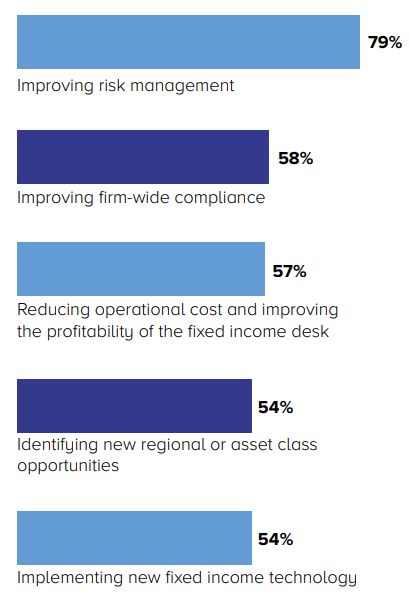

Respondents were asked to select all that apply

With multiple markets under the fixed income umbrella, regulatory requirements are constantly changing and rarely in a uniform way. Addressing regulatory change requires a significant amount of resources because it touches so many different parts of the firm including operations, technology, and legal.

– Alex Sedgwick, Market Structure and Electronic Trading Consultant,Fincisive Strategies

Globally, the market is still dealing with a backlog from MiFID II. The effects are ongoing, but it’s still unclear whether the initial intent of increasing market transparency and access to data has actually been achieved. Old regulations such as Dodd Frank are coming up against new technologies, and navigating the new landscape with these regulations is going to be a challenge.

– Lauren Harrison, Conference Director, Fixed Income Leaders

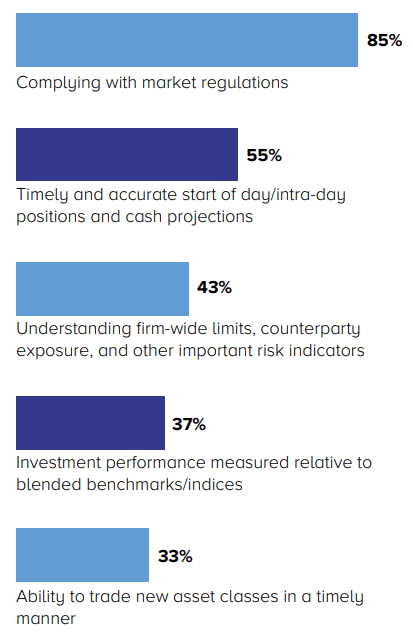

Respondents were asked to select all that apply

Automation is challenging because it ultimately rests on the buy versus build decision. Building is resource intensive, but you’ll have a more transparent tool tailored to your existing workflow. If you buy, you’ll need to make a more substantial investment in monitoring third-party tools and adjust your workflow. Expect to see a combination of the two as the market evolves.

– Alex Sedgwick, Market Structure and Electronic Trading Consultant, Fincisive Strategies

These responses largely reflect the percentage of the business that is high-touch versus low-touch. The need for capital is dependent on the type of trade and since bonds often don’t have a two-way market in block size, capital commitment is more important. The breakdown here reflects the extent to which block trades still make up the majority of traded volume.

– Alex Sedgwick, Market Structure and Electronic Trading Consultant, Fincisive Strategies

Preference for principal or agency depends on the nature of the trade and where we are able to source best execution. Generally speaking, we prefer agency brokers when trading listed derivatives and principal when trading OTC.

– Tracy Rucker-Wilson, Global Portfolio Risk Manager – Fixed Income, Vanguard

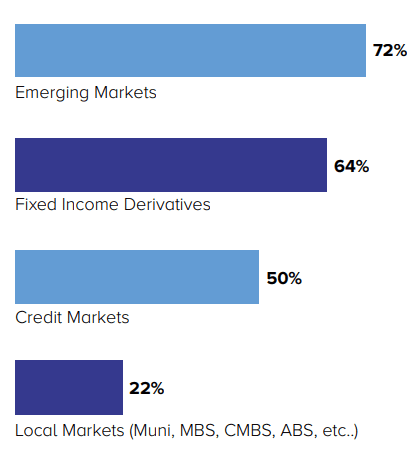

Emerging markets is a totally unique asset class, traders are dealing with banks they don’t recognize, regulations they’re unfamiliar with and a whole new set of risks. Essentially, they’re going into these trades blind, so they need a platform that has contacts in those regions. Trades take a lot longer in emerging markets, but if you get it right it can be a really lucrative opportunity.

– Lauren Harrison, Conference Director,Fixed Income Leaders

Respondents were asked to select all that apply