Last month's difficult meeting between Chinese and U.S. diplomats in Anchorage may mark the next escalation in tensions between the two nations. New sanctions on Chinese officials before the summit set the tone for the discussions. We don't expect current economic and trade measures imposed by the U.S. to be removed. The chasm between interests on both sides looks set to limit any cooperation. We expect the summit's outcome to provide more impetus for the U.S. to impose more restrictions and for China to retaliate accordingly.

Steps the U.S. may take include wider export restrictions on technology, investment restrictions for U.S.-based capital, and expansion of financial sanctions against China state and non-state entities. China's response may include rare-earth embargoes and restrictions on inbound direct investment.

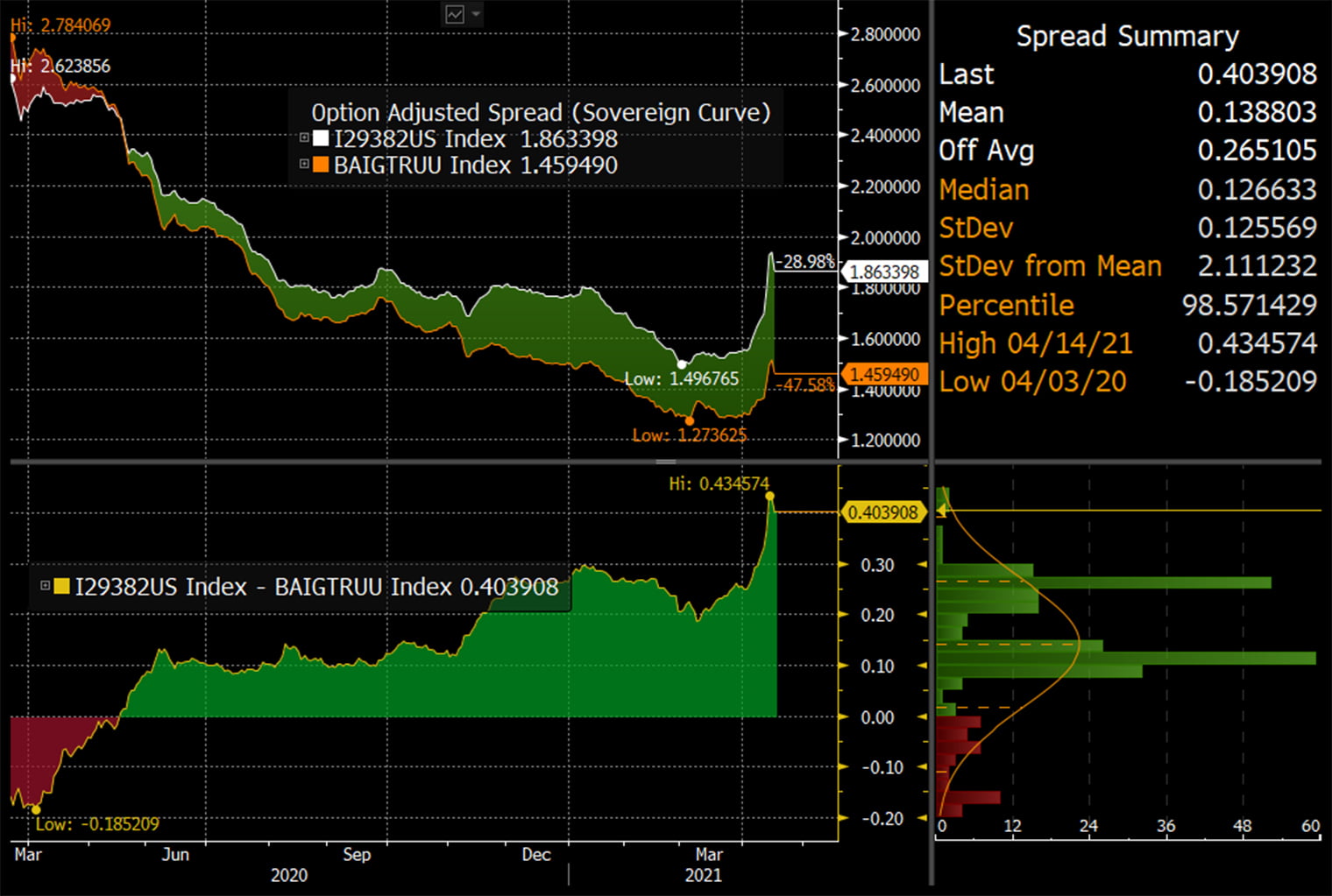

Source: Bloomberg Intelligence

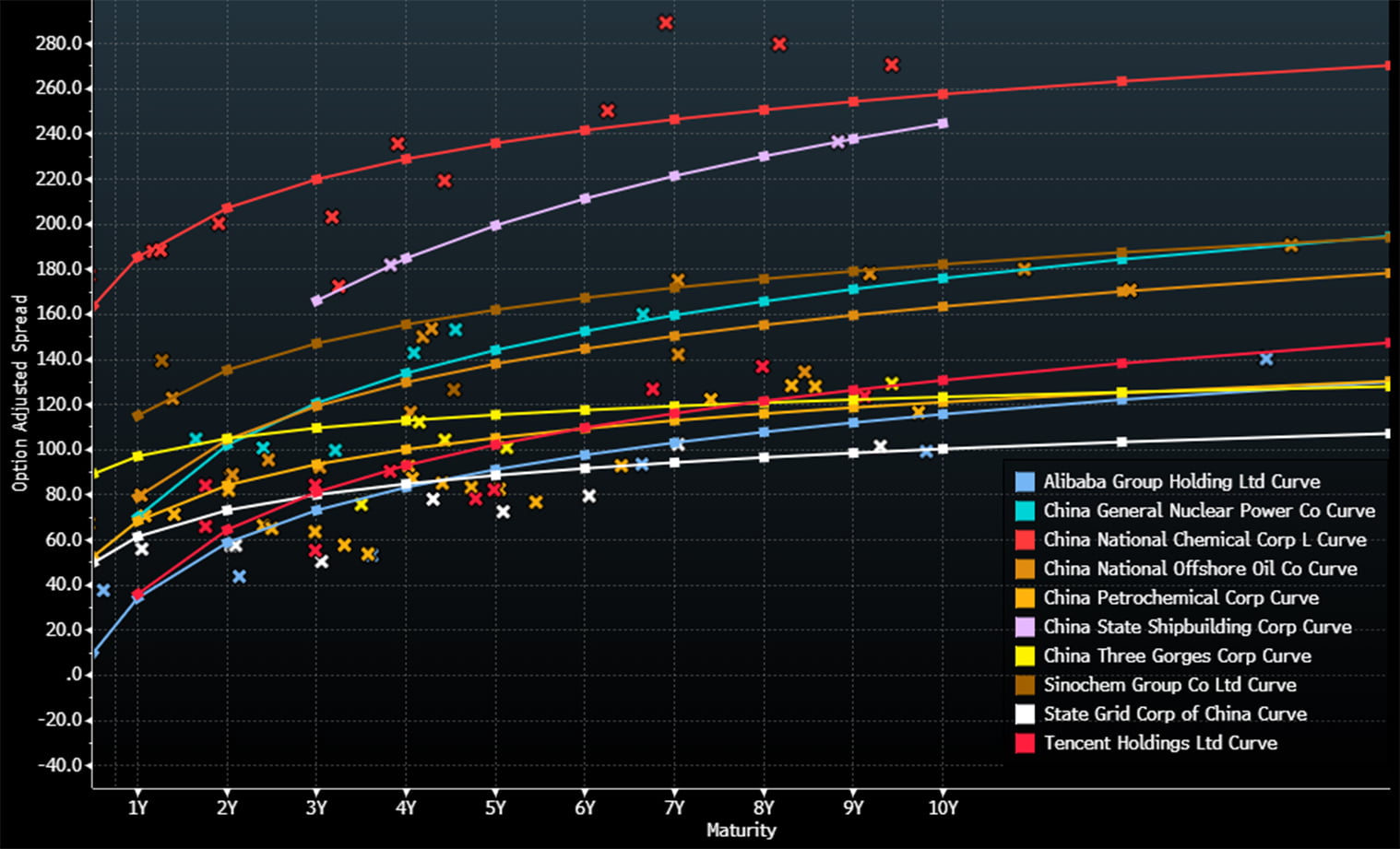

Chinese sovereign-owned entities sanctioned by the U.S., which are generally strategic entities, trade wider than non-sanctioned sister companies and private corporations. China Nuclear Power Group trades wider than Alibaba and Tencent, private tech entities. Similarly China Three Gorges Corp, a key power-generation company, trades at a discount to the State Grid of China. Sanctioned companies in general trade wider though fundamentally, they generally have similar metrics to non-sanctioned SOEs and enjoy similar strategic status. Names that are currently not sanctioned risk joining those on the list as China-U.S. tensions continue to rise. From a credit-metrics perspective, one might view the sanctioned groups as offering better value.

And if geopolitical tensions lessen, sanctioned issuers may outperform.

Source: Bloomberg Intelligence