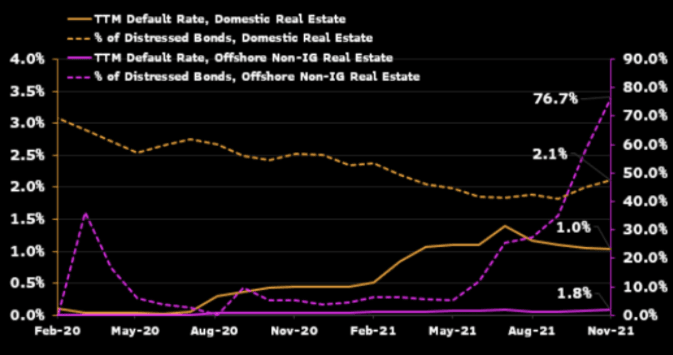

Evergrande Group warned investors that the company may not have sufficient liquidity to support financial obligations in a press release on Dec. 3. The PBOC then published an announcement within an hour to calm investors, stressing Evergrande's saga is basically a single-name event. It said the risk wouldn't create contagion or undermine the fund-raising function of the market. The PBOC also suggested that U.S. dollar bond market is "mature", implying any default can be resolved via the market mechanisms.

So panic selling arising from fund redemptions, cuts in margin loans for leveraged professional investors and the bulk of rating downgrades could be behind us. Policy adjustments will help sentiment, but we don't expect full-blown policy easing. We identify characteristics of real-estate developers that may survive the current carnage and a possible endgame for the sector.

Portfolio diversification key due to weak financial transparency

For investors looking to buy the sector, a diversification strategy aimed at low priced bonds with relatively strong characteristics (see below) may be effective. Weak financial transparency for debt obligations and the state's mandate to protect homebuyers first and then retail investors in wealth-management products render any recovery analysis futile. Apart from the issue of onshore cash issue at the project level, previously due construction payables may need to be cleared before building work can resume, further constricting liquidity.

Source: Bloomberg Intelligence

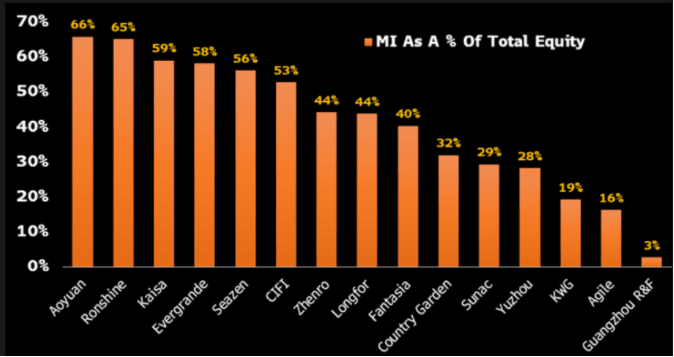

We would be cautious on developers that are struggling to pay coupons. Defaulted issuers may need to endure a lengthy onshore bankruptcy process that in the past has delivered weak recovery to offshore bondholders. Developers that have substantially high minority interests should be avoided as asset sales may be more difficult and proceeds may not flow back to the holding company for debt repayment purposes.

Survivors are likely to be able to do equity financing, have strong recurring rental income and have a property management arm that can mimic Agile's recent corporate action. We prefer certain BB issuers for relative value (see below) over B issuers that seem to suffer from weaker financial transparency.

Source: Bloomberg Intelligence

Source: Bloomberg Intelligence

What's the endgame for the sector?

We see part of the endgame being sector consolidation and the state taking more control of the property sector and aligning it more with the country's objectives. The financially weakest companies will be weeded out and the remainder will grab more market share. China has already stated its goal of common prosperity and rising home prices create social unrest which goes against this. Hence, we see full blown easing as not an option for the state.

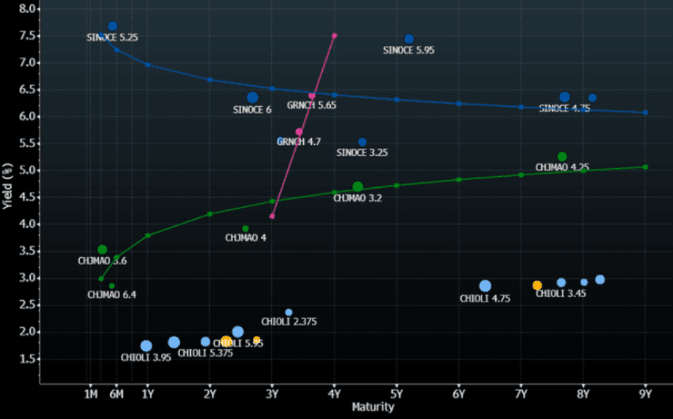

Property SOEs will likely remain in business and we see any sell down, like Sino-Ocean Land (SOL) recently, as a relative value opportunity. Even though SOL is financially ringfenced from China Life, its largest SOE shareholder, China Life has previously supported SOL via buying SOL’s debt.

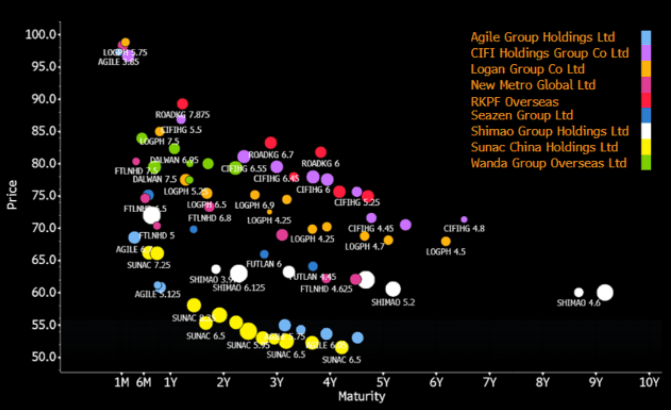

Some China property BB bonds may tighten faster on rebound

In a rebound scenario, Agile bonds' could reach prices similar to the slightly higher rated Sunac (B1/BB/BB) and post similarly high returns; this could be explained by the former's stronger access to offshore loan market although the latter is much bigger in terms of contracted sales. Dalian Wanda bonds could also tighten after the company shifted its focus to property leasing and management. Shimao is a new joiner after being downgraded.

At the other end, Logan, Seazen, CIFI, and Road King with yield levels between mid- to high-teen are comparable with some investment grade names like Sino-Ocean. A lack of news headlines to spur interest in these niche BB players could be the reason for the comparable yield despite the rating difference.

Source: Bloomberg Intelligence