China real estate default rate may break 5%

China's December default rates may worsen on the back of missing payments by Evergrande and Kaisa. Kaisa's progess toward finalizing a preliminary restructuring proposal and other developers' recent, successful asset sales to state-owned enterprises sparked a positive reversal in the mark-to-market value of China high-yield bonds. We believe some issuers which have weak fundamentals and are defying the "three red lines" regulations on leverage may eventually default, while the bond prices of survivors will rebound. Hence, diversifying among issuers with strong fundamentals is key to avoiding single-name driven events.

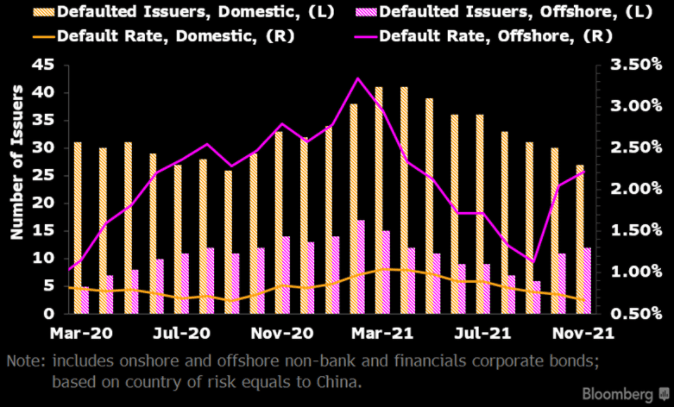

Default rates for November increased marginally to 2.2% in China's offshore high-yield market and to 0.66% in its domestic market, based on an early snapshot that we gathered via Bloomberg BQL.

Source: Bloomberg Quant Platform (BQuant), Bloomberg Intelligence

Source: SRCH <GO>, Bloomberg Intelligence

In the offshore market, Chongqing government-owned Chongqing Energy Investment defaulted on an interest payment for its 2022 maturity bond on Nov. 8 but was able to redeem the bond in full in the following week. This may strengthen investors' confidence in dollar bonds issued by the Chongqing municipality. Landbridge Group's 2021 maturity was the only bond that missed a payment in the domestic market.

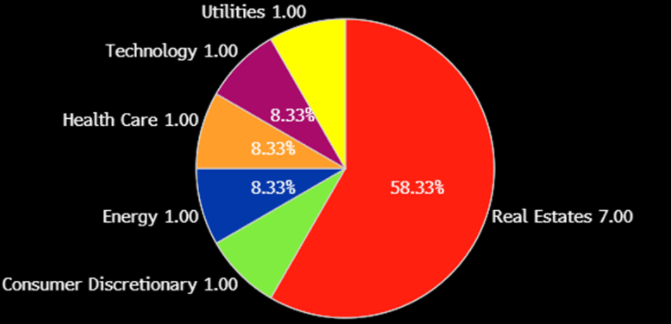

By sector, real estate continues to dominate U.S. dollar issuer-based bond defaults (58%), while technology, utilities, healthcare, energy and consumer discretionary comprise the remainder.

Source: Bloomberg Quant Platform (BQuant), Bloomberg Intelligence

Source: Bloomberg Quant Platform (BQuant), Global Data

Debt maturity decreased on YoY basis

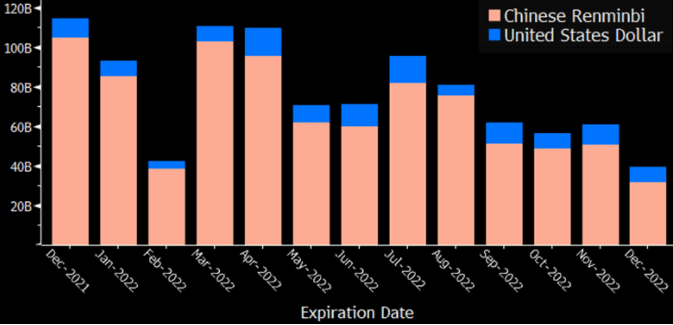

The Chinese domestic corporate-bond market may face less refinancing risk arising from upcoming maturities. In December, 428 non-bank, non-financial issuers in the onshore market will face a total of 661 billion yuan of debt-principal payments, equivalent to 2.7% of the total market amount outstanding (AO). This is a significant improvement from 755 billion yuan (3.4% of market AO) in the same period last year. On a sector level, real-estate issuers have 67 billion yuan (4% of sector AO) of maturies, down from 4.8% of sector AO in December 2020.

Maturity distribution in China's offshore bond market in December will improve compared to the same month last year, which means there should be less refinancing risk, pointing to lower market volatility. Thirty-seven offshore issuers will face $8.4 billion of maturities equivalent to 1.4% of market AO. This is down from $9.4 billion or 1.7% in December 2020. Investment-grade and non-rated issuers each have $3.8 billion of maturities. High-yield issuers' debt distribution will improve significantly in December, with only $764 million (0.5% of AO) of outstanding principal payments.

Source: DDIS <GO>, Bloomberg Intelligence