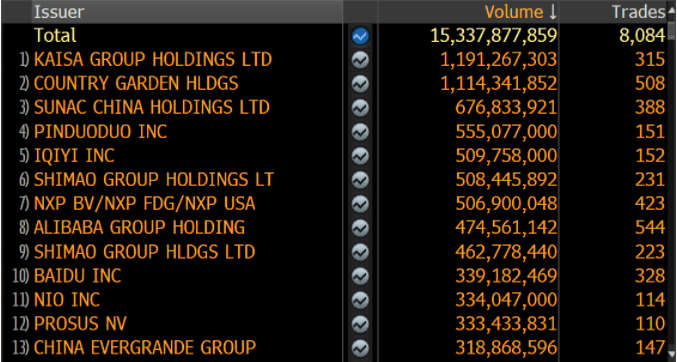

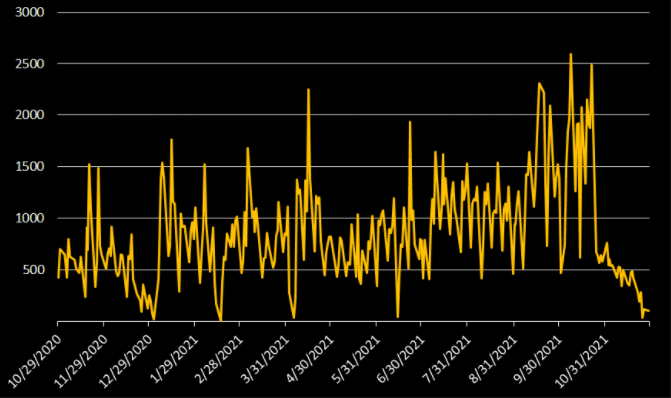

Source: TAGG <GO>; based on TRAC and MIFID monthly data

Source: TAGG <GO>; based on TRAC and MIFID monthly data

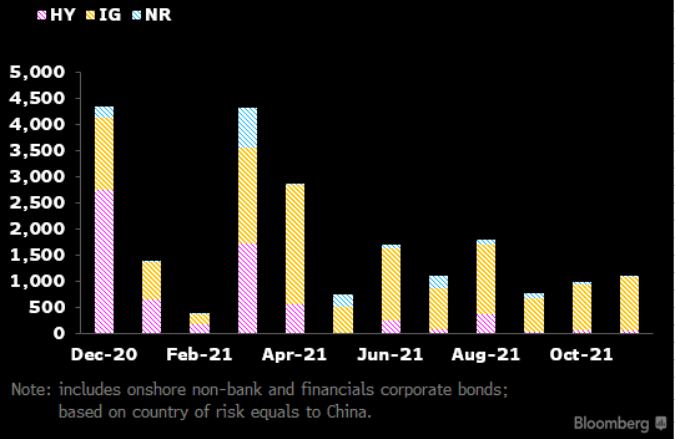

Source:Bloomberg Quant Platform (BQuant), Global Data

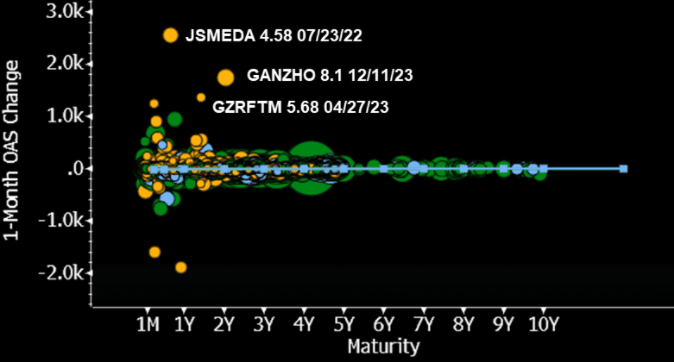

Option-adjusted spreads (OAS) for AA rated domestic fixed-rate medium-term notes, at 202 basis points as of Nov. 28, continued to show more resilience against spread-widening than their offshore dollar-bond peers. In November, when real-estate names dominated headlines and caused volatility in the offshore market, the average OAS for the sector's AA bucket in the domestic market remained stable at about 165 bps. By contrast, AA+ rated airline issuer JuneYao Group suffered a selloff across its medium-term notes due to the Covid-19 resurgence in China in early November.

Use FIW@CN <GO> to see the yield change based on local ratings and issuers of China's domestic bonds by sector.

Source: FIW@CN <GO>, Bloomberg Intelligence