China credit may outperform Asia ex-China on flow and policies

The Southbound Bond Connect may support China dollar bonds in 2022, especially in the investment-grade segment, relative to the rest of Asia. At the same time, China's policies to address the liquidity issues in the real estate sector could drive the high yield sector in 1H22, as well continued buybacks and maturity restructuring by the firms.

China USD credit performance hinges on Southbound flows

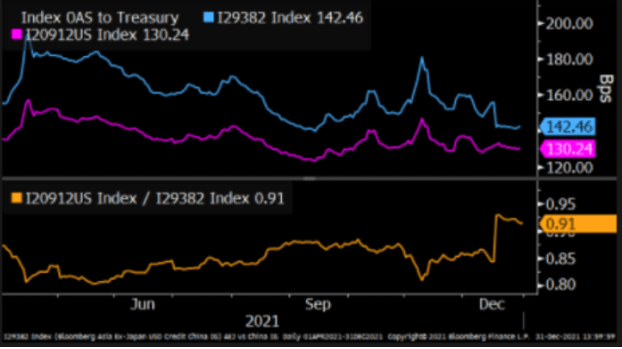

China-related investment grade bonds may benefit from capital flows from the domestic pool of investment funds, which could cushion the segment against dollar related headwinds. The inauguration of the Southbound Bond Connect will allow domestic qualified investors to access the China offshore bond market. It may help contain any widening of credit spreads due to dollar macro factors, if the offshore market moves too wide versus the onshore bonds. Capital flows into the China IG market from the domestic investors on wider spread differentials will shift the volatility from the bond market to the FX market.

That also means that from a relative value performance perspective, China-related IG bonds may outperform the Asia ex-Japan IG index if the market sees downside volatility.

Source: Bloomberg Intelligence

Source: Bloomberg Intelligence

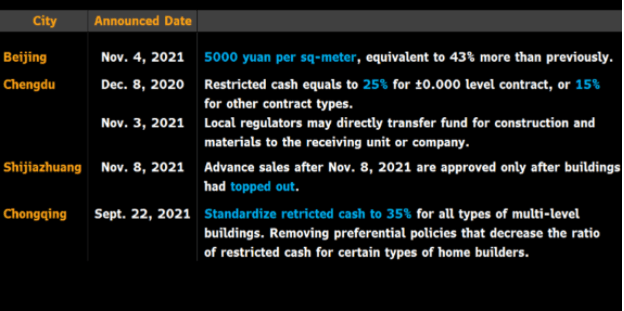

Buybacks and debt exchanges to accelerate in 1Q22

As cross-border payments rules are relaxed at SAFE to allow bond issuers to remit funds for debt management, we expect the frequency of debt buybacks to accelerate into the first quarter of 2022. At the same time, real estate firms facing lumpy debt payments are likely to stagger their maturities via debt exchanges given the current state of the offshore bond market for the sector. If default is not the base case for markets, then the valuations for Chinese real estate bonds may rise from the current levels. The current problems facing the sector is one of liquidity, not solvency. The underlying market remains stable, though fears of developer failure and project incompletion has hit market sentiment. Regulators have begun to address these concerns and we expect more measures into the new year to stabilize the market.

Source: Bloomberg Intelligence

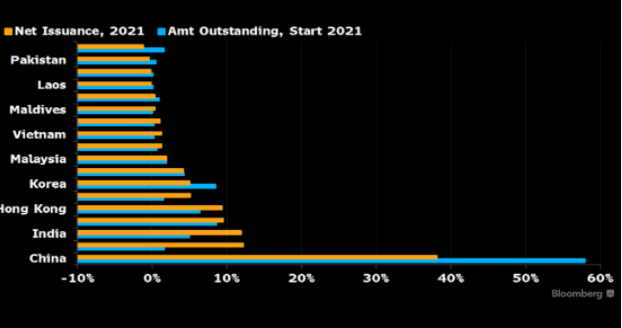

We expect supply from China corporate issuance in the dollar market in 2022 may further diminish relative to the current market share on deleveraging balance sheets and renewed focus on capital performance. In 2021, we saw net issuance from China decline below its share of the overall market and below 50%. We expect this trend to continue in 2022 as the basic dynamics of issuance in USD remain the same. China's deleveraging process will continue while the continuing pandemic forces more issuance from Asia ex-China, ex-Japan.

Also, as China's domestic market continues to grow, and SAFE cross-border rules are relaxed, we may see more on-shore issuance to replace maturing offshore dollar bonds. That will further reduce pool of China bonds in the market and increase their scarcity, which may support the segment.

Source: Bloomberg Intelligence