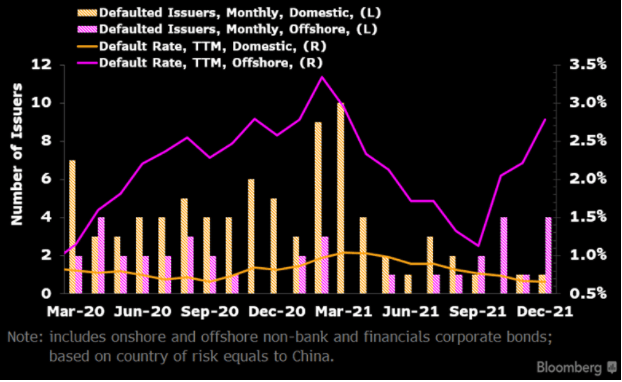

Default rate may rise in January

The offshore dollar-bond default rate may climb above 2.9% if two or more names among the market's 551 issuers default their interest or principal payments in January. The dollar-bond default rate climbed to 2.78% with Evergrande's subsidiary Scenery Journey (TIANHL) and Kaisa Group defaults in December 2021.

In a scenario where Evergrande (EVERRE) was the only issuer to default in January, we may see the dollar-bond default rate drop to 2.7%. However, Chinese homebuilders default risk will continue to linger with issuers facing higher seasonal refinancing pressure with $6 billion of dollar-bond maturities due this month. In addition to Evergrande, one more defaulting issuer will suffice to shoot the default rate over 2.9% in January.

Source: Bloomberg BQNT <GO>, Bloomberg Intelligence

We recorded $3.8 billion of offshore dollar bonds and 500 million yuan ($78 million) of domestic bond defaults based on bond amounts outstanding, involving four offshore dollar-bond issuers and one domestic yuan issuer. The trustee has confirmed non-payment of interest on the TIANHL $590 million note, following Evergrande's failure to pay coupons post the grace period. However, the $645 million note remains "flat trading" as the market awaits official confirmation on the coupon payment status from Evergrande, the issuer, or the trustee.

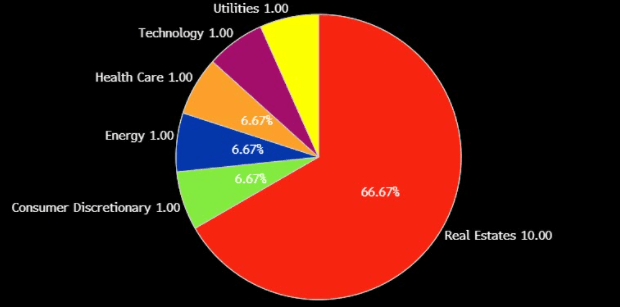

By sector, real estate continues to dominate U.S. dollar issuer-based bond defaults (58%) on a trailing 12-month basis, while technology, utilities, healthcare, energy and consumer discretionary comprise the remainder.

Source: SRCH <GO>, Bloomberg Intelligence

Source: Bloomberg BQuant <GO>, Bloomberg Intelligence

Source: Bloomberg RATT <GO>

Source: Bloomberg Quant Platform (BQuant), Global Data

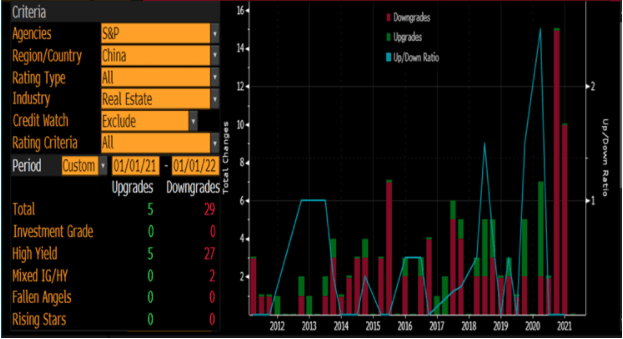

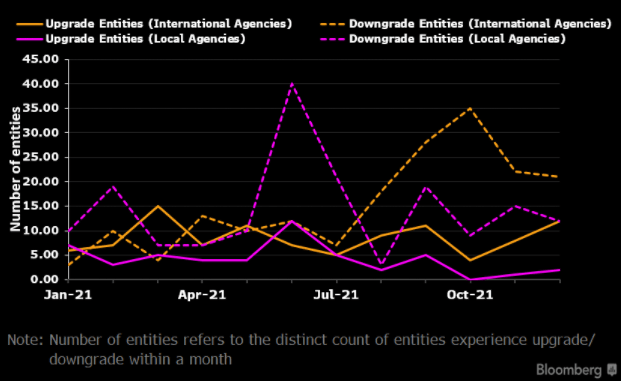

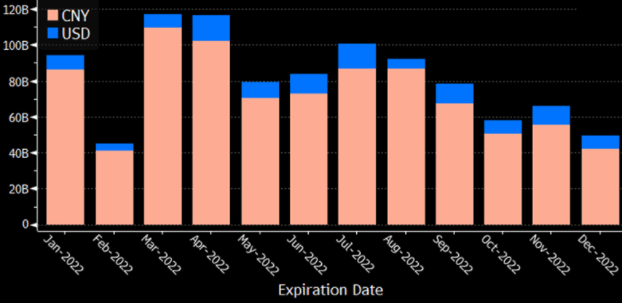

China's corporate-bond markets, onshore and offshore combined, may face less refinancing risk arising from upcoming maturities. In January, 529 non-bank, non-financial issuers will face a combined $91.6 billion of debt-principal payments, equivalent to 2.2% of the total market amount outstanding. This is smaller than $109.2 billion (2.8% of the total) in the same period last year. On a sector level, real-estate issuers have $16.5 billion maturity, or 2.2% of the sector total, down from 2.7% in January 2021.

Meanwhile, investors may need to pay closer attention to distressed issuers due to pay interest or principal in January, such as Yuzhou Group, Guangzhou R&F, and RongXingDa Development. Click on the data tab for a list of bonds that have interest or principal due.

Source: DDIS <GO>, Bloomberg Intelligence

Source: Bloomberg TREN <GO>

Source: Bloomberg GP <GO>