Source: Bloomberg Intelligence

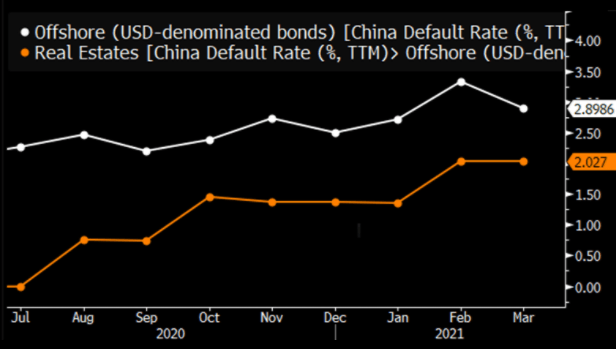

China's property issuers maintained a low default rate among their peers from other sectors in the USD-denominated market, based BI's most recent data. Idiosyncratic-driven default events, including China Fortune Land Development (CHFOTN) and Tianjin Real Estate Group (TJREDM), have spurred the market's attention on China corporates' delinquencies. However, our calculations based on Bloomberg's Quant platform (BQuant) indicated that the issuer-based default rate of USD-denominated bonds in China's property issuers remains safe at 2.03% in March 2021. This is 0.87 percent points lower than the market-level of 2.90%.

The four property developers included in the March 2021 default rate calculation are Tahoe Group (THHTGP), China Fortune Land Development (CHFOTN), Yida China (YIDCHL), and Tianjin Real Estate Group (TJREDM).

Source: Bloomberg Intelligence

Bloomberg Intelligence has created a new proprietary data series tracking the 12-month rolling credit default rate based on the number of issuers rather than on the amount outstanding for both onshore and offshore markets. This series is more aligned with how rating agencies track credit defaults globally and would be able to provide an insight into the trend of Chinese institutional defaults and also, in combination with the default rate by amount outstanding, on the composition of the defaulted pool.

The criteria is similar to the default rate based of amount outstanding. The series calculates the default rates based on the number of issuers that have defaulted against the number of issuers at the beginning of a period, which in this case is one year.

Source: Bloomberg Intelligence

We calculated China's default rate by dividing the amount of defaulted bonds to the outstanding amount of bonds by Chinese issuers. Corporate bonds are considered by Bloomberg Data to be in default in these circumstances: when the clearing house or exchange where the bond is traded disclose a bond default, when the issuer misses payment of a coupon and/or principal, when issuers breach certain covenants such as cross-default covenants, file for bankruptcy, or are unable to fund early redemption by bond holders. Bloomberg uses these standardized rules to monitor and capture events when corporate bonds default.

The SRCH <GO> criteria used is available in the Data link below our exhibit.

Source: Bloomberg Intelligence