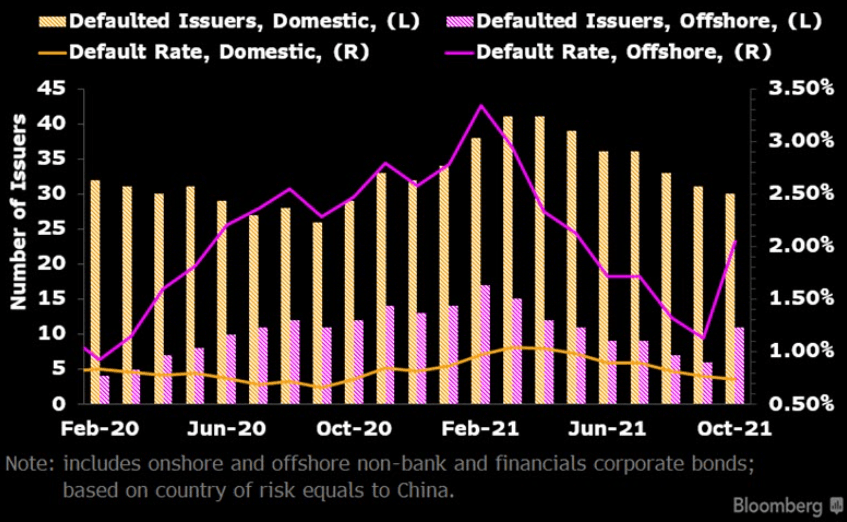

Defaults may drop in the near term

China's issuer-based default rates may drop in November, when principal maturity will fall in both domestic and offshore dollar markets. While a systematic default is unlikely to happen in China's bond market, single-name-driven idiosyncratic risk remains.

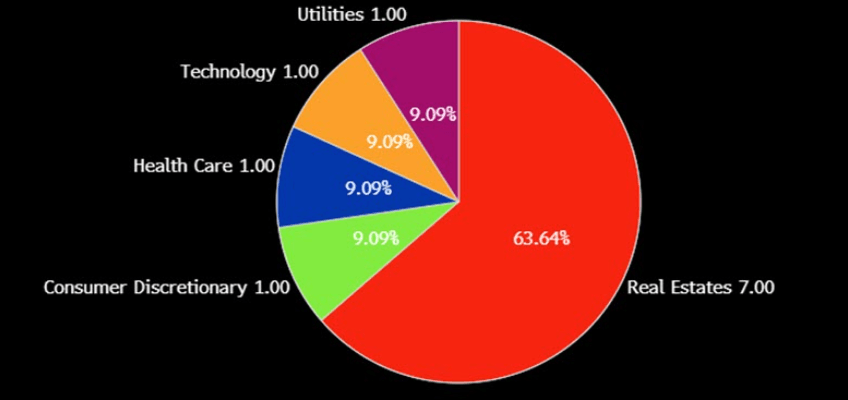

China's October and November default rates will hinge on Evergrande's resolution of its dollar-bond interest payment within the 30-day grace period ending Oct. 23. Offshore high yield's default rate based on amount outstanding could rise to about 9% if Evergrande fails to make payment, as we previously highlighted. Yet issuer-based default rates will barely move, given the risk is contained within the single-name level. Overall, Chinese real estate companies have little evidence of fundamental-driven systemic issues. It's unlikely to see systematic default coming in the near term, but single-name-driven credit risk may spur market price volatility. Portfolio diversification is key to avoid idiosyncratic risk. We hold to our view that market-level spread may reverse from such mispricing.

Source: Bloomberg Quant Platform (BQuant), Bloomberg Intelligence

Source: SRCH <GO>, Bloomberg Intelligence

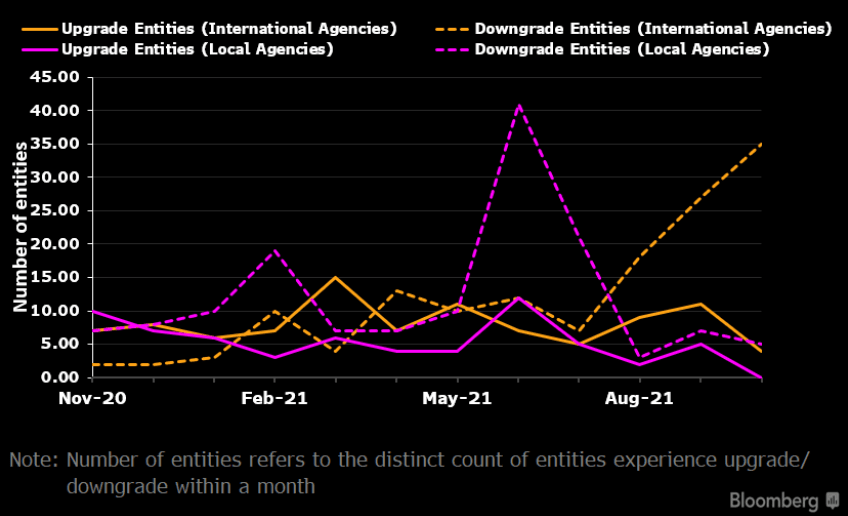

Source: Bloomberg Quant Platform (BQuant), Bloomberg Intelligence

Source: Bloomberg Quant Platform (BQuant), Global Data

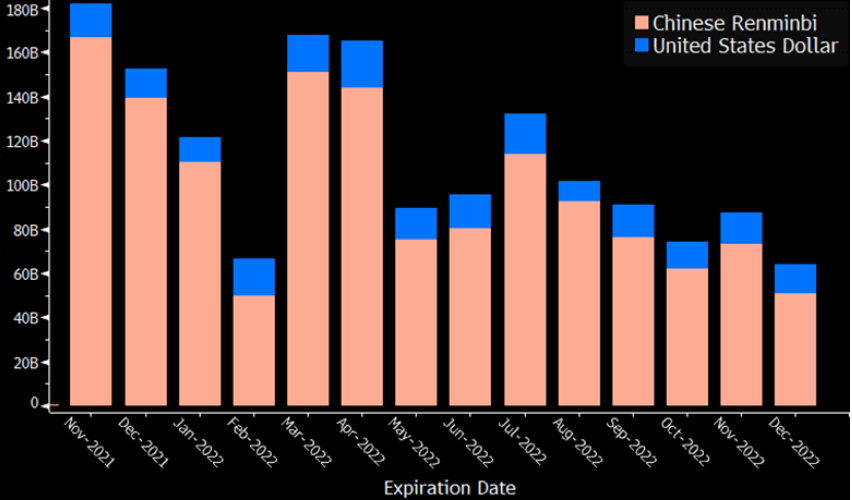

Debt maturity

China's domestic bond market faces 568 billion yuan in maturities, with $1.3 billion for dollar offshore.

Chinese domestic corporate bond market may see less refinancing risk arising from upcoming maturity. In November, 420 non-bank, non-financial issuers in the onshore market will face a total of 568 billion yuan debt principal payment, equivalent to 2.7% of the total market amount outstanding (AO). This is a significant improvement compared to the 729 billion yuan (3.7% of market AO) in the same period last year, and will happen across nearly all sectors except health care. In particular, real-estate issuers have 62 billion yuan maturities or 1.95% of sector AO, down from 2.3% in November 2020.

Maturity distribution in China's offshore bond market in November will improve compared to the same month last year, which means there should be less refinancing risk, pointing to lower market volatility. In November, 24 offshore issuers will face $7 billion of maturity, equivalent to 1.2% of the market AO. This is down from $9.2 billion or 1.7% of market AO in November 2020. Investment grade and non-rated issuers have $3.8 billion and $3.7 billion of maturity, respectively. High-yield issuers' debt distribution will significantly improve in November, with only $1.3 billion (0.7% of high-yield outstanding) outstanding principal payment.

Source: DDIS <GO>, Bloomberg Intelligence