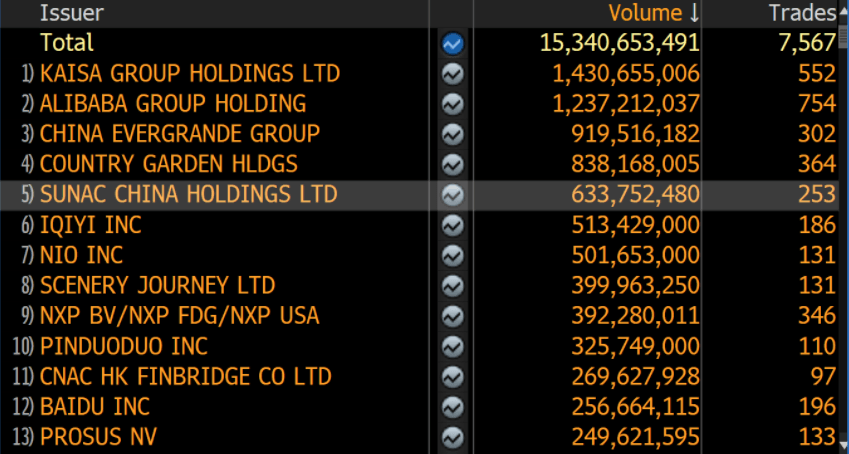

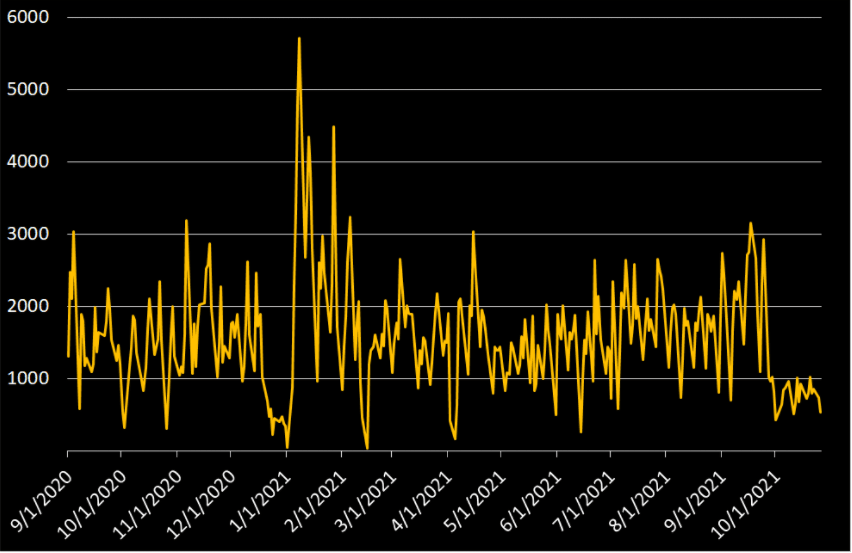

Source: TAGG <GO>; based on TRAC and MIFID monthly data

Source: TAGG <GO>; based on TRAC and MIFID monthly data

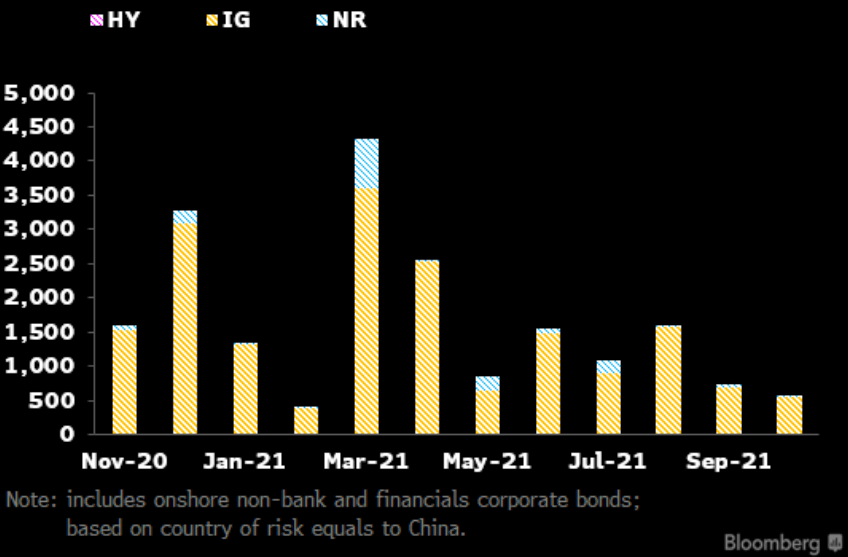

Source:Bloomberg Quant Platform (BQuant), Global Data

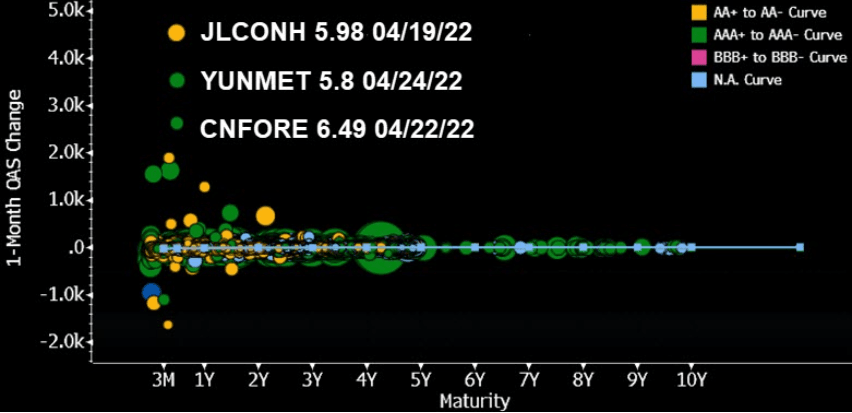

Option-adjusted spreads (OAS) for double-A rated domestic fixed-rate medium-term notes, at 212 bps as of Oct. 26, may prove more resilient to widening than their offshore dollar-bond peers. During October, even when real estate names dominated headlines and spurred volatility in the offshore market, the average OAS for the sector's AA bucket in the domestic market remained stable at about 168 bps. In contrast, materials' AA bucket was the laggard of the month, with Chengtou-issuer Jilin City Construction's 5.98% note due in 2022 widening by 4,500 bps on concerns regarding "city investment belief", a term that describes local governments' endorsement of Chengtou credit and thus its immunity to default.

Use FIW@CN <GO> to see the yield change based on local ratings and issuers of China's domestic bonds by sector.

Source: FIW@CN <GO>, Bloomberg Intelligence

China investment-grade bonds may continue to outperform high yields in November amid the flight to quality, underpinned by high volatility in both equity and bond markets. Many high-yield bonds, especially in property, may have a higher risk of meltdown as refinancing channels deteriorated in October following a series of defaults and accelerating downgrade actions by rating agencies.

The China High-Yield Index's option-adjusted spread widened to about 20% in October from 15% in September while the Investment Grade Index's remained flat.