China Southbound: The People’s Bank of China and Hong Kong Monetary Authority jointly announced that Southbound Bond Connect will commence on September 24, offering onshore Chinese investors the option to invest in Hong Kong’s bond market. Together with China Foreign Exchange Trade System (National Interbank Funding Center) ("CFETS"), Bloomberg will launch new solutions on September 24, based on the system connectivity between both parties, to facilitate seamless trading on the Southbound Bond Connect. The new solutions will enable offshore dealers to provide market making services for onshore investors. Bloomberg will provide security master data and valuation data for eligible securities and the relevant data will be displayed on the CFETS platform upon launch.

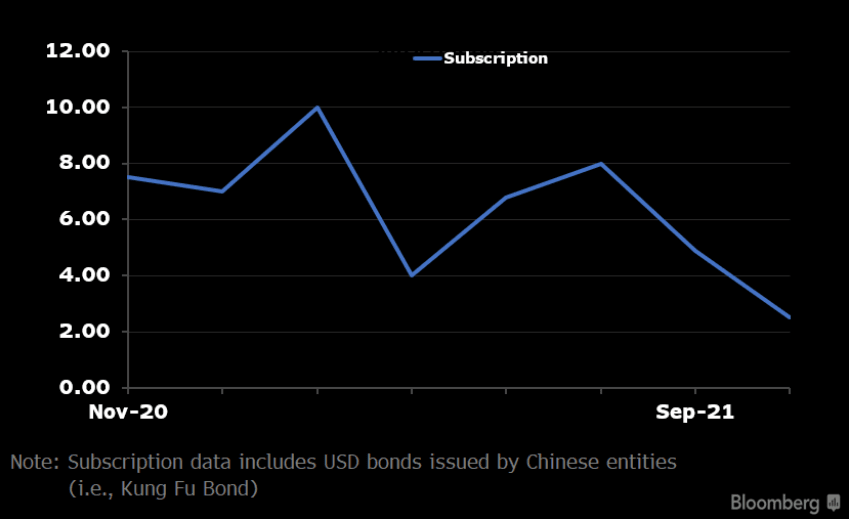

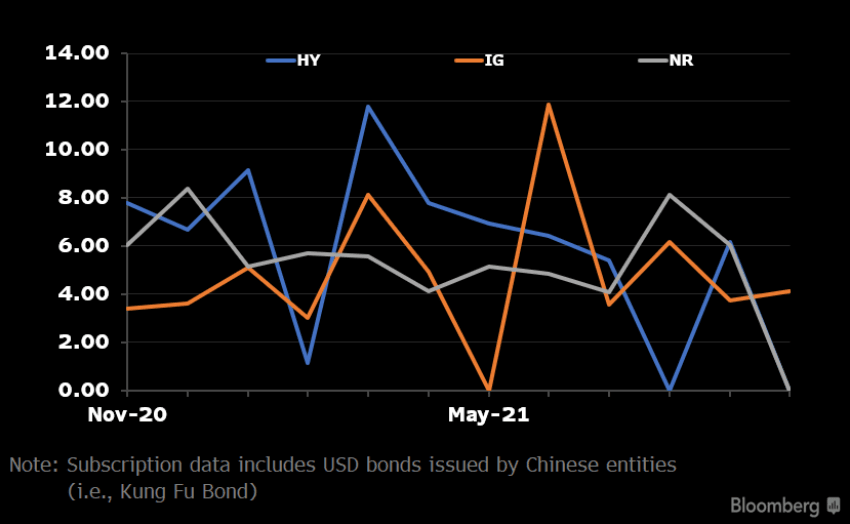

Kungfu Bond: In 2018, following consultation and a survey with over 400 market participants across Asia, Bloomberg unveiled “Kungfu bond” as the industry reference for offshore U.S. dollar bonds issued by Chinese companies and financial institutions.

IG/HY/NR: For offshore bonds, credit rating below BBB- is considered as High Yield, whereas onshore takes rating below AA as High Yield.

Functions quoted in the report:

- WCDS: world CDS monitor

- DDIS: debt distribution

- TAGG: trades aggregate

- FIW: fixed income worksheet

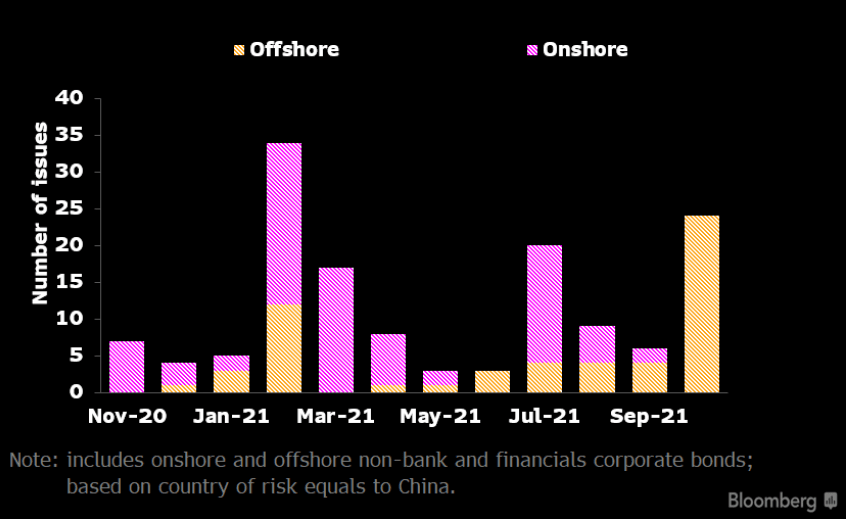

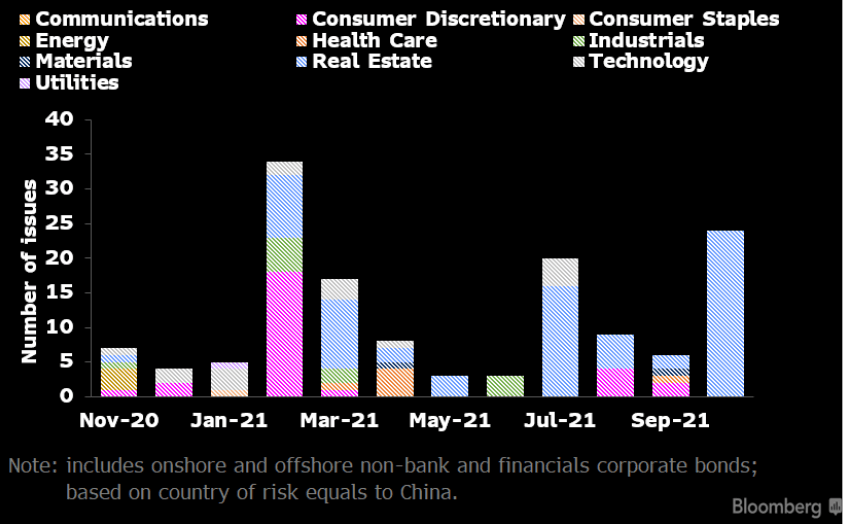

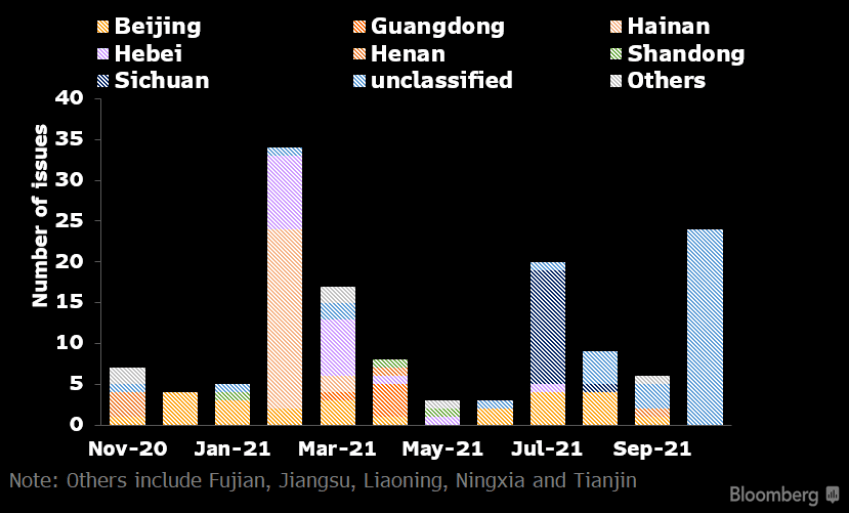

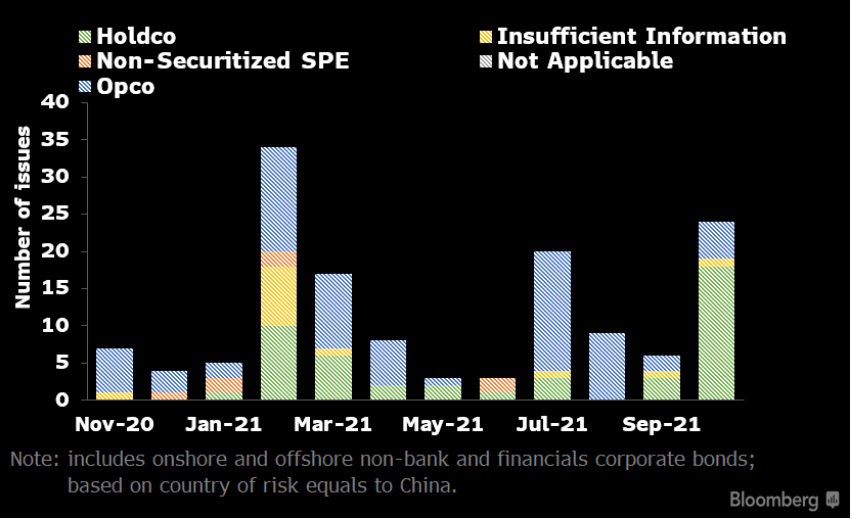

Source: Bloomberg Quant Platform (BQuant), Global Data

Source: Bloomberg Quant Platform (BQuant), Global Data

Source: Bloomberg Quant Platform (BQuant), Global Data

Source: Bloomberg Quant Platform (BQuant), Global Data

Source: Bloomberg Quant Platform (BQuant), Global Data

Source: Bloomberg Quant Platform (BQuant), Global Data

Source: Bloomberg Quant Platform (BQuant), Global Data

Source: Bloomberg Quant Platform (BQuant), Global Data

John Lee, Regional Market Analyst, Bloomberg Intelligence

Dan Wang, Credit Analyst, Bloomberg Intelligence

Jason Lee, Credit Analyst, Bloomberg Intelligence

Qi Li, Product Manager

Adrian Yim, Fixed Income Data Analyst

Allen Yan, Regulation & Credut Data Specialist

Shawn Qui, Fixed Income Data Analyst