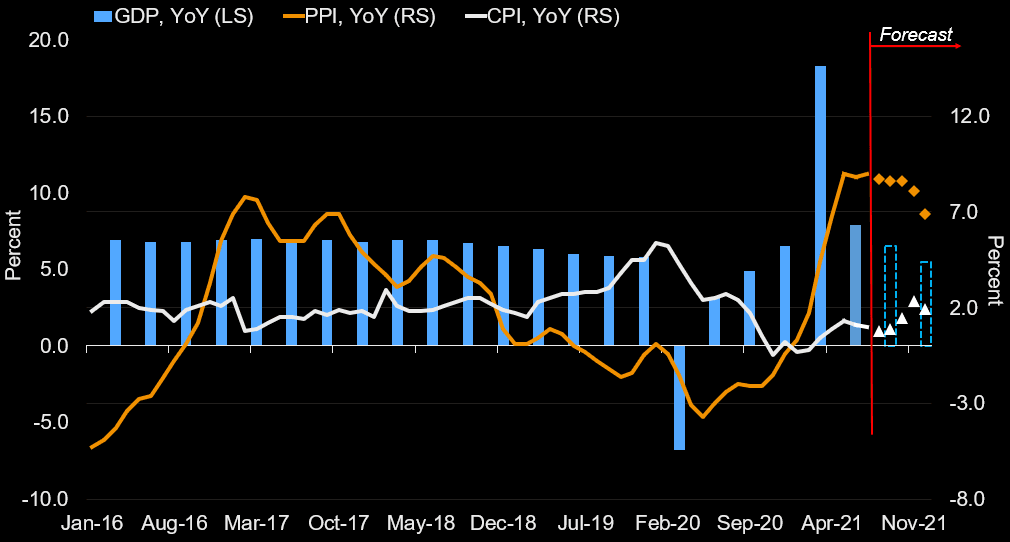

Source: NBS, Bloomberg Economics

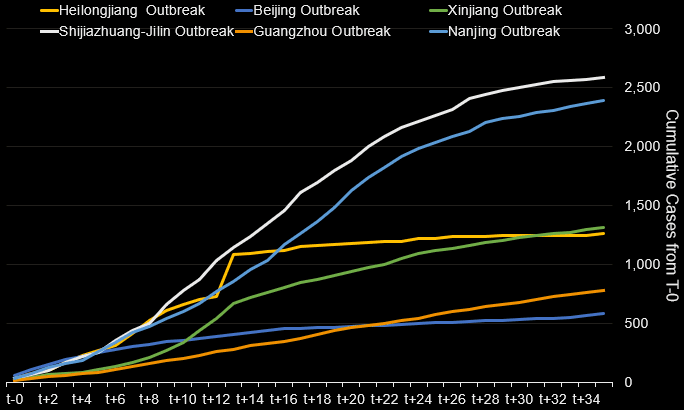

Source: Dingxiang Doctor, Bloomberg

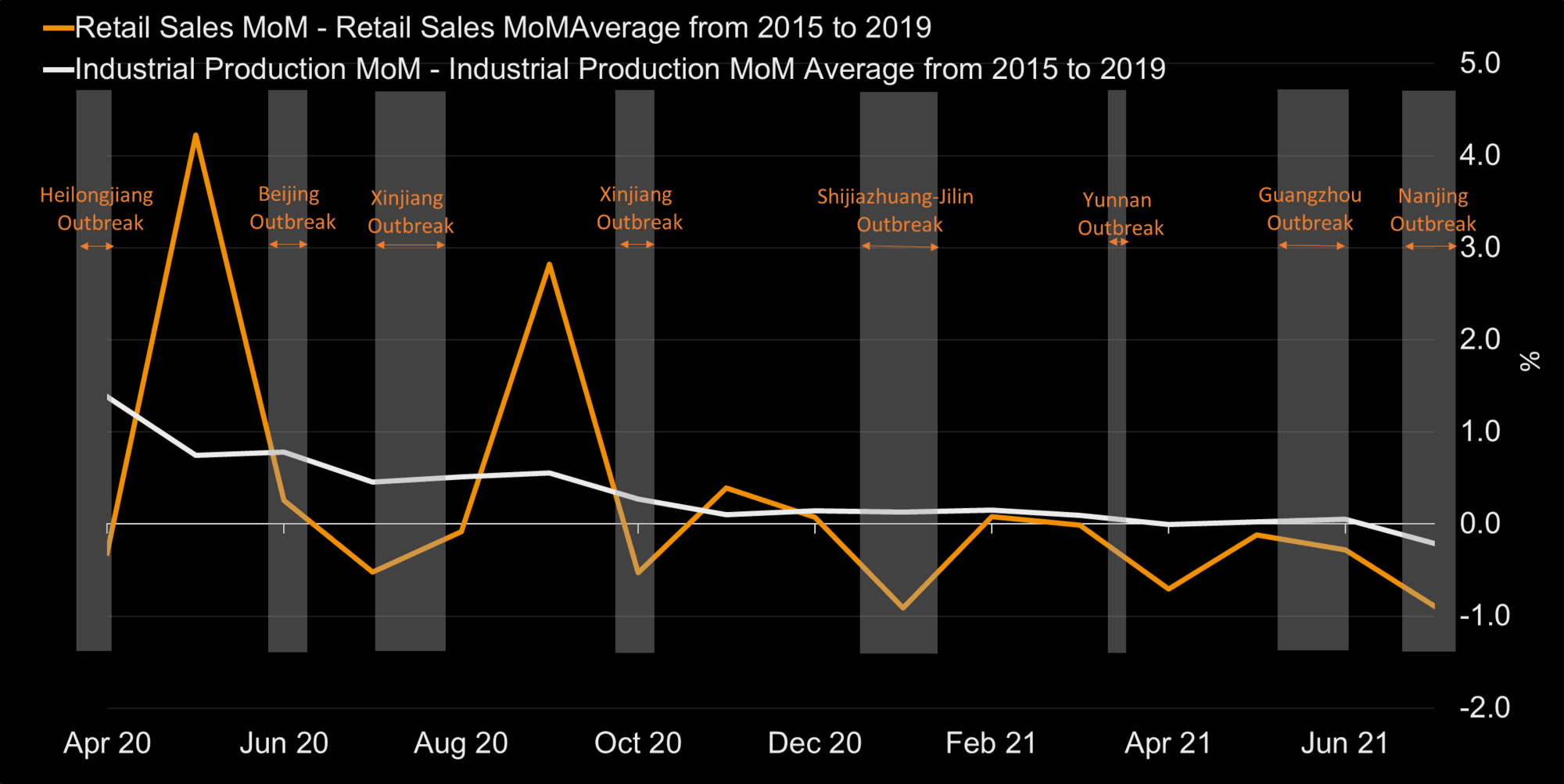

Source: NBS, Bloomberg Economics

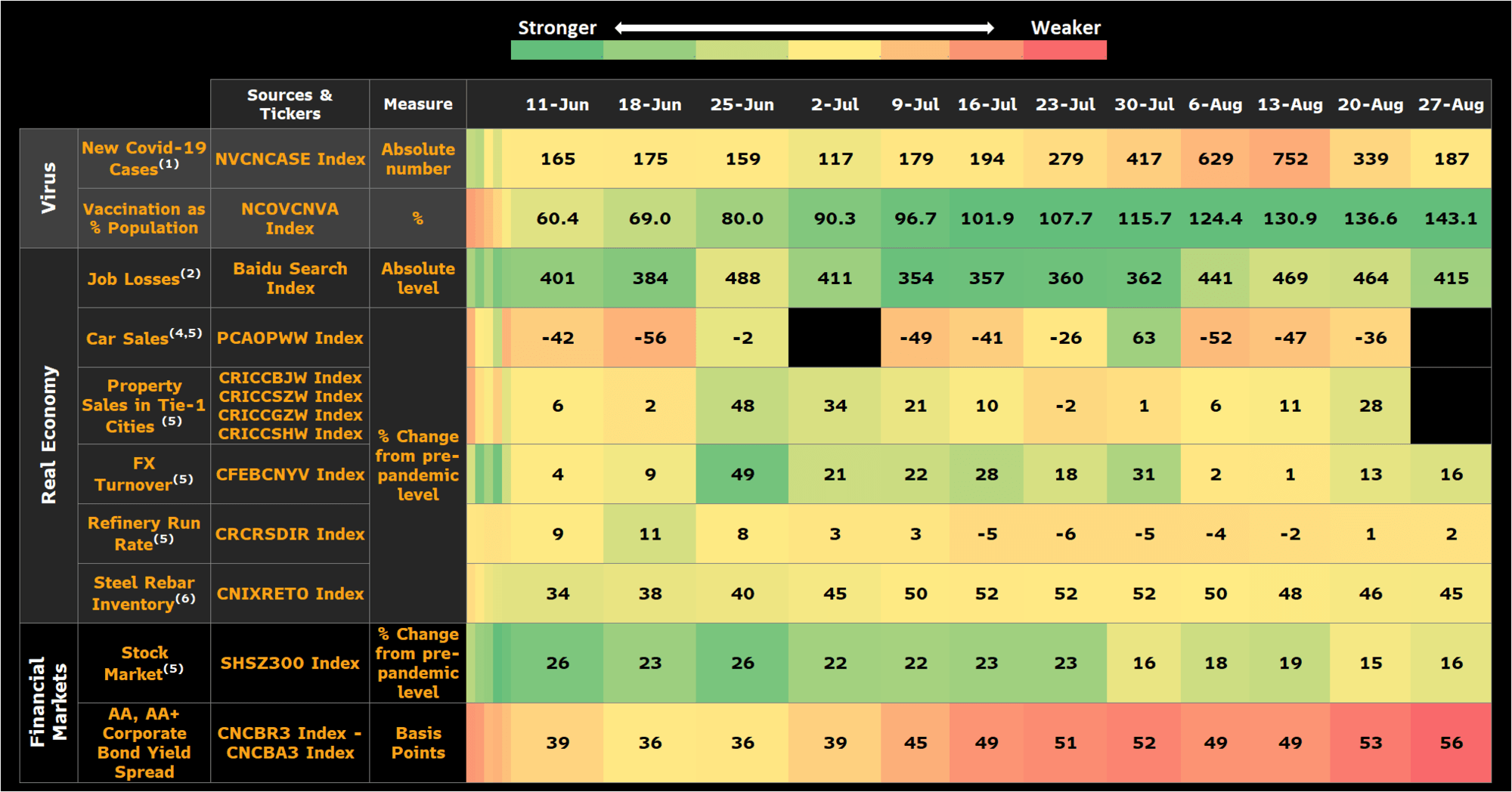

Source: Bloomberg Economics, Health Commission of China, CPCA, Shanghai Longzhong, CFETS, CUSTEEL

Notes: 1. Weekly new Covid-19 confirmed, cases based on data from Bloomberg News and Chinese government. 2.Baidu index, compiled based on users’ search of key word ‘job losses’. 3. Car sales data are from China Passenger Cars Association, but the CPCA week alignments are different from the calendar week we use in the dashboard, so we just refer to the data to show a rough trend. 4. The Car Sales, FX Turnover, Refinery Run Rate, Property Sales and Stock Market are percentage changes from the average of pre-pandemic level (4Q 2019 and the first two weeks in Jan 2020). 5. Steel Rebar Inventory is the % change from its 2019 average level. 6. We removed 10-city metro passenger data from our dashboard, as data have been not available since June 2021. 7. The ratio is calculated as the cumulative number of vaccine does administered, compared with total population.

Going forward, production could see some upside -- especially if the global economy holds up -- but regulatory factors on several fronts will be key to the outlook.

- With China working toward its carbon-neutrality commitment, production restrictions on emission-intensive sectors are likely to continue.

- Policies aimed at reining in a heated housing market have intensified since 2H 2020. Major steps include the “three red lines” policy regulating developers’ funding behavior, capping land sales to three times a year for major cities, and a shift in land sales revenue collection to central tax authorities from local governments.

- Tighter measures have also been implemented on education companies and the technology sector.

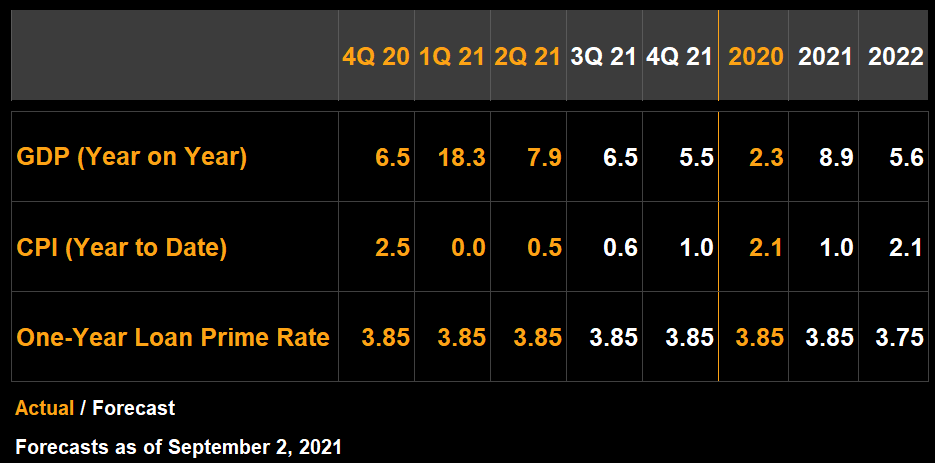

Against this weaker backdrop, the tempo of support policy is likely to pick up in 2H 2021, following some tightening in 2H 2020 and 1H 2021. But it won’t be aggressive -- the aim is to cushion the slowdown, not jack up growth.

We expect the government to step up fiscal support through increased infrastructure spending. We also think the People’s Bank of China will deliver another 50 basis point cut in the reserve requirement ratio in the next two months. Read more here.

Source: NBS, PBOC, Bloomberg Economics