The announcement from the regulators on the driving principles to develop the market includes consolidating regulations, unifying the different markets and strengthen risk management and professionalism. State policy will dictate issuance policy.

China announces opinions on future bond market developments

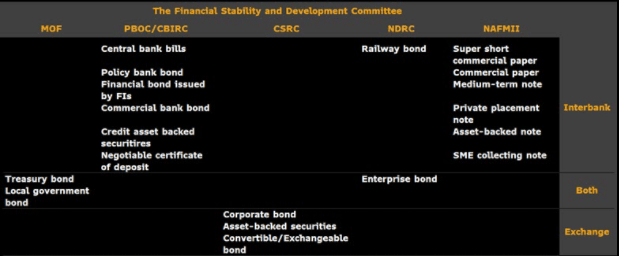

On the August 18, six main financial market regulatory bodies announced the state council's opinion on how the domestic yuan bond market should proceed. The statements opine on the steps needed to be taken on the legal, regulatory, market structure front to further develop the corporate-bond market. The first of these steps has already been announced in new credit rating agency regulations announced on August 6. More regulations are likely to follow from this announcement. We expect new rules to be drafted for the consolidation and fungibility between the interbank market, and the exchanges in

Source: Bloomberg Intelligence

It's likely that China will restrict bond issuance that does not conform with the development and industrial objectives of the country. One of the primary objectives is financial stability and leverage reduction. Highly levered entities may be prevented from issuing new bonds (relative to re-financing transactions) while sectors that are viewed as opposing state policy may face similar restrictions. The approach to the bond market will be similar to the one used on the banking system.

Structured placements of bonds are specifically prohibited. This comes about from the use of illegal underwriting and placement methods, like self-purchase or intra-group purchase of bonds to give the wrong perception of risk to markets. Issuer, underwriters and originators may be subject to more stringent regulations going forward.

Source: Bloomberg Intelligence

The regulatory agencies in China will likely consolidate the regulatory framework each has in relation to the corporate bond market and create a unified system of laws to prevent regulatory arbitrage. This is an issue in China with respect to leverage limits in relation to domestic and external debt, and short/long term bond issuance. Uniform disclosure requirements, debt-issuance approval, and clear distinction of risks to prevent co-mingling of repayment responsibilities are likely. New laws may be drafted to penalize issuer principals, shareholders and executives for disregarding the regulations. The "zero tolerance" approach will be used to deal with debt evasion.

Strict implementation of the Budget Law will apply to government and provincial related entities, especially in relation to hidden debt.

Source: Bloomberg Intelligence

China seeks to expand the size of the investor base for Chinese corporate bonds, but at the same time, wants to improve the knowledge base, and qualifications of these investors. The basic principle of "sellers responsibility, buyers beware" will drive policy. China streamlined non-bank financial institution licensing in July 2021 but in the future may include staff licensing, akin to Hong Kong's system. This is in line with the drive to improve risk management and professionalism in qualified investment institutions, while at the same time, not over-regulate the industry to the point of inflexibility.

Regulatory oversight for these institutions, along with institutions on the origination side of the market, will increase as measures taken to improve information disclosure and investor protection expand.

Source: Bloomberg Intelligence