Unfortunately, traditional credit risk analysis is not well-suited for events that occur suddenly with little warning because that analysis relies heavily on data that updates infrequently – for example, company fundamentals. To help address this gap, Bloomberg has launched a new Market Implied Probability of Default (MIPD) calculation that captures daily market sentiment from the fixed income market, and converts that sentiment into a leading credit health indicator. Clients can leverage MIPD to better measure and monitor risk during unpredictable news cycles, such as we witnessed recently with China Huarong.

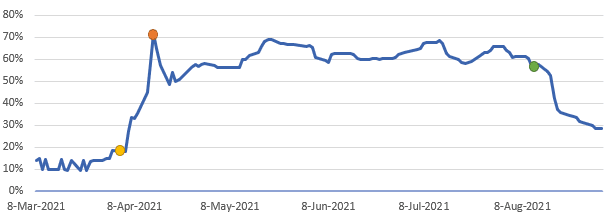

When China Huarong postponed the release of its 2020 financial reports at the end of March 2021, the markets quickly reacted with fear that the company’s credit health had deteriorated and the Chinese government could let the bank default on its debt. After months of uncertainty, the Chinese government decided to bail out China Huarong and avert a wider financial crisis. However, if your credit risk framework relied purely on traditional credit ratings, this

Image 1: Huarong MIPD values on a 5 year over the last 6 months

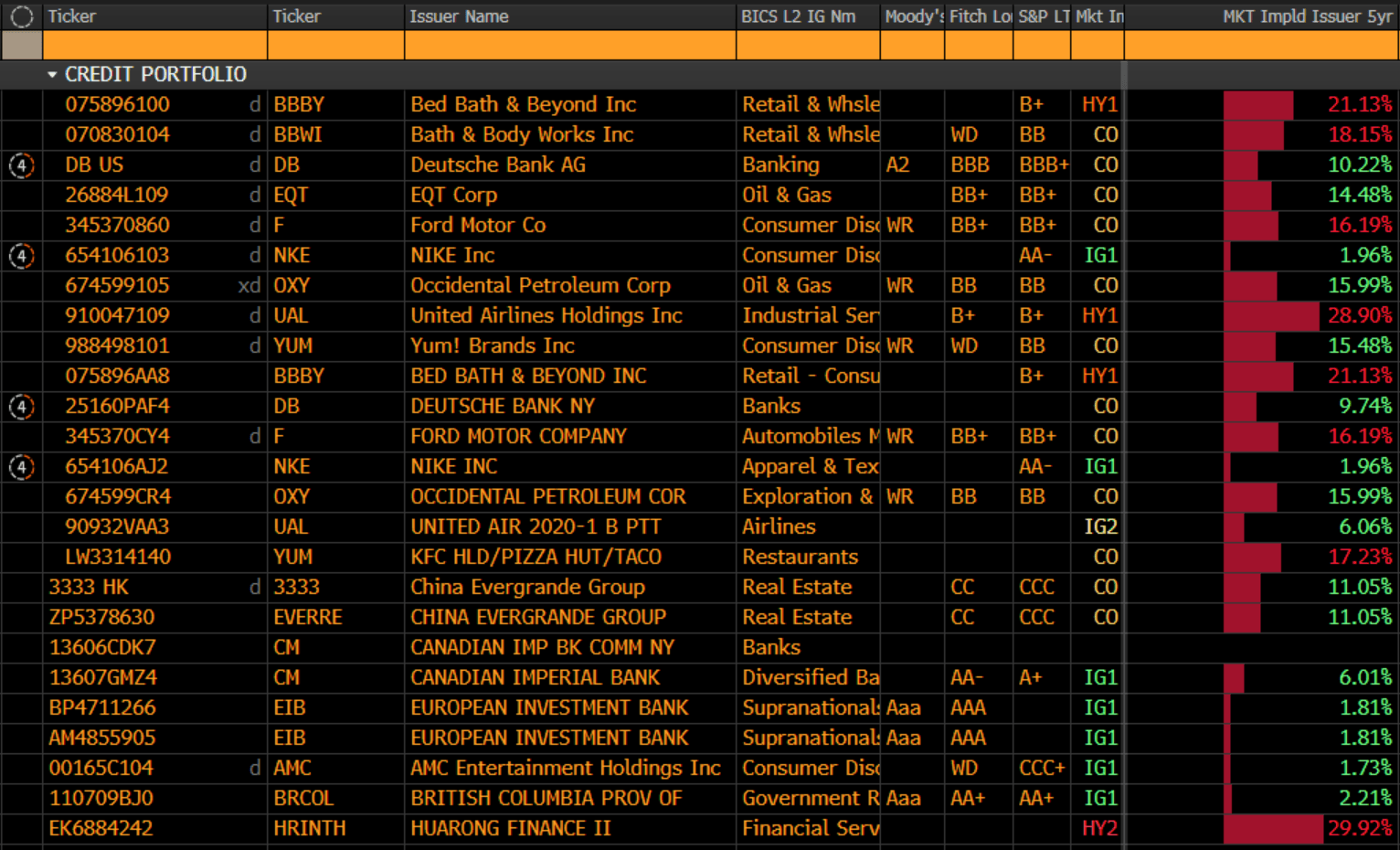

Image 2: Huarong MIPD value as of September 9th 2021

As of mid-September 2021, Huarong’s MIPD levels remain high despite the government bailout, especially compared to its current credit ratings. Most major rating agencies place China Huarong in the lowest tier of investment-grade debt. However, the MIPD classification of “High Yield 2” indicates that the fixed income market continues to price China Huarong debt in the same way as extremely low-quality, high-yield instruments. The rating agencies may be satisfied by the terms of the government bailout, but market participants seem to think there are still significant risks that need to be monitored.

Banks and investors need to proactively manage credit risk during fast-paced and unpredictable news cycles. Timely and reliable data has become mission critical in managing risk and generating compelling risk-adjusted returns, especially for firms that monitor long lists of companies and need early-warning indicators to tell them where to focus their attention (and resources) each day. Bloomberg leverages its unique position in the market to provide valuable market-driven insights – like MIPD – to assist clients in monitoring future events driven by unpredictable factors such as China’s increased regulatory crackdowns across multiple industries.