Source: Bloomberg Intelligence

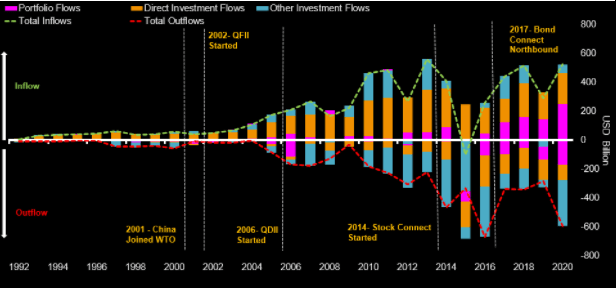

- The large gap between inbound and outbound capital flows is a product of China’s past emphasis on opening inbound channels before outbound routes.

- The two-way Wealth Management Connect and the southbound Bond Connect are among a number of recent steps aimed at restoring more balance.

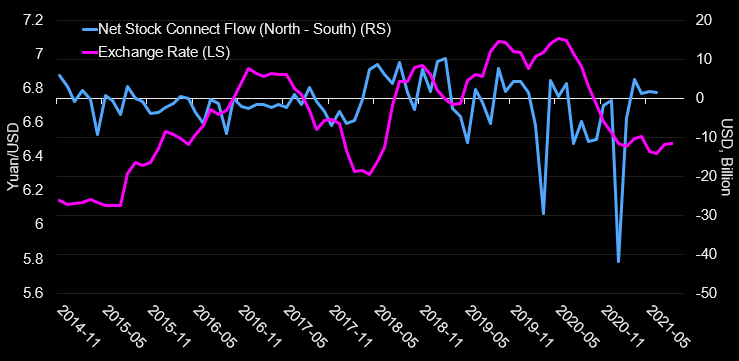

- The willingness to allow more cross-border flows suggests the authorities are less worried these days about sudden surges in outflows that could drive down the yuan.

Wealth Management Connect and Southbound Bond

The Wealth Management Connect Pilot Scheme launched on Friday allows investment in Chinese financial products by residents from Hong Kong and Macau in the onshore market, and by residents in the Greater Bay Area in the offshore segment.

There’s a cap of 150 billion yuan ($23 billion) in each direction, and a limit of 1 million yuan for individual investors. The products are limited to non-complex, medium-risk instruments.

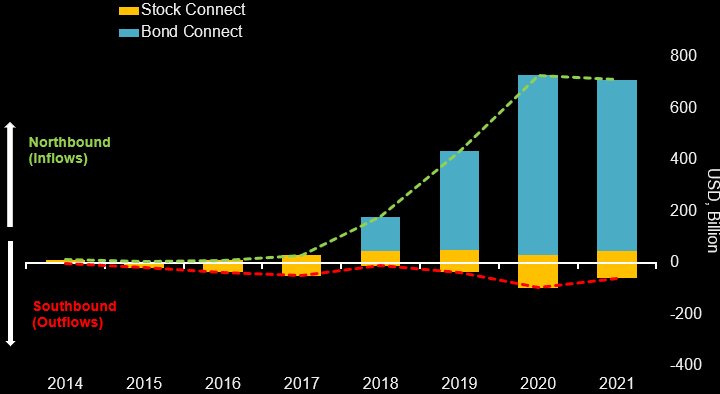

Southbound trading in the Bond Connect will enable domestic market players to invest in bonds in overseas markets. The opening of this channel comes four years to the month after China began northbound trading in the Bond Connect. It follows a series of Stock Connect programs, which China introduced in 2014 and gradually widened in scope.

Programs to help correct inflow-outflow imbalance

China has been accelerating the pace of financial opening. Among the recent big moves, it allowed full foreign ownership of Chinese financial companies ahead of schedule in 2019, and removed a quota for the Qualified Foreign Institutional Investor scheme in May 2020.

China’s limited financial linkages with the rest of the world -- which are particularly meager relative to the size of its economy and its importance in trade -- point to the importance of continued financial opening.

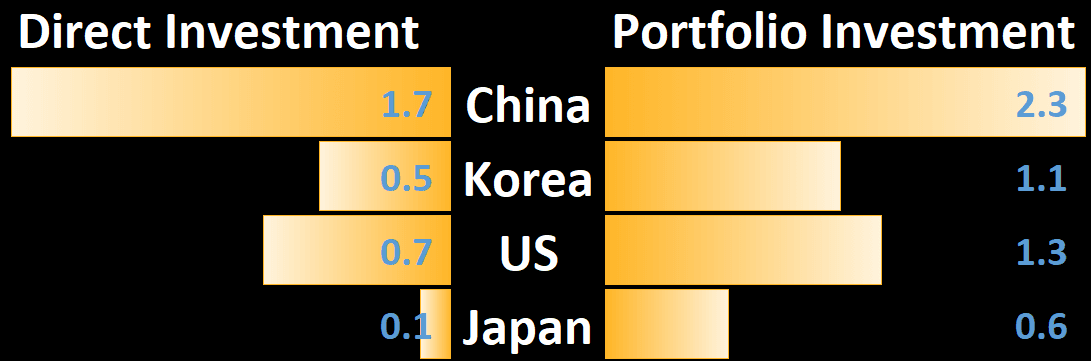

- Even with rapid growth over the past decade, China’s portfolio flows with the rest of the world -- inbound and outbound combined -- amounted to $1.8 trillion at end-2019, just 2.4% of the world total.

- This is equal to 13% of China’s GDP, far lower than comparable ratios for the U.S. (125%), Japan (142%) and South Korea (74%).

Source: International Monetary Fund, Bloomberg Economics

Source: Hong Kong Stock Exchange

Source: Hong Kong Stock Exchange, Bloomberg