The objective of this science-based body of work is to help direct private capital towards long-term, environmentally sustainable activities, and prevent false claims on the environmental nature of an investment product.

The Taxonomy will help market participants ensure they invest in truly green opportunities that align with the Paris Agreement on greenhouse-gas emissions, and don’t fall foul of ‘greenwashing’ attempts. As a corner stone of the European Commission’s Sustainable Finance Action plan, it will underpin new regulations, notably requiring investment firms to clarify the ‘greenness’ of their investment strategies using a common language.

On the launch of this important document, we wanted to dispel

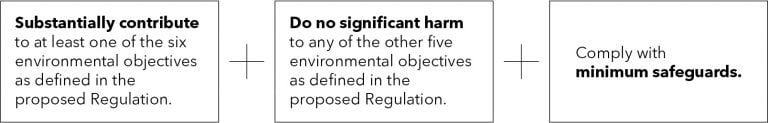

glossary that defines Paris agreement-aligned performance criteria over a set of economic activities, such as the manufacture of aluminum. To claim alignment with the Taxonomy, economic activities need to substantially contribute to one of 6 environmental objectives, not significantly harm any other (Do Not Significantly Harm, DNSH in the figure below).

The 6 environmental objectives defined in the Taxonomy are:

I. Climate change mitigation: a company’s impact on the environment

II. Climate change adaptation: the environment’s impact on a company

III. Sustainable use and protection of water and marine resources

IV. Transition to a circular economy, waste prevention and recycling

Figure 1: EU Taxonomy proposal

investment products, private and occupational pensions, individual portfolio management, and both insurance and investment advice. The reporting framework will take the shape of a “comply or explain” requirement. This means that if an investment firm claims its products have environmentally sustainable objectives, it will need to disclose the nature and extent to which the product aligns with the Taxonomy. If not, it will have to have to state that the product does not align.

scope industries were initially decided based on their greenhouse gas emissions profiles[2], where ‘greener’ alternative practices exist for them to follow. For some industries, such as aviation, the technology does not yet exist for these criteria to be set.

NACE industries such as growing of stone fruits, growing of citrus fruits and growing of grapes are included under the Taxonomy activity “Growing of perennial crops.” Testing criteria are set at the activity level.

The technical expert group recognizes that detailed screening criteria will be updated over time, in recognition of the speed with which new technology and science-based solutions are emerging. In addition, a number of economic activities are yet to be assessed. In order to assess these new activities, the European Commission have formed a Platform

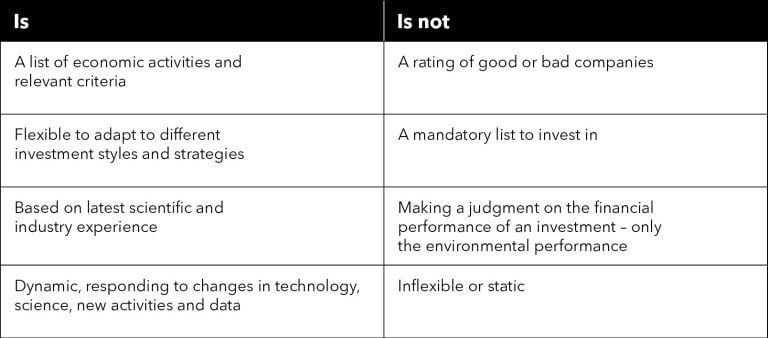

Figure 2: Taxonomy explanation. Source: TEG June 2019 draft usability guide

example, if 10% of a fund is invested in a company that makes 20% of its revenue from Taxonomy-aligned activities, the fund is 2% Taxonomy-aligned for that investment, and so on.

Once the Non-Financial Reporting requirements are live, companies will have to disclose their Taxonomy-aligned turnover and capital expenditure, which will make the reporting process easier for investment firms.

capital expenditures aligned to Taxonomy criteria, it can use it as a percentage value across a whole fund, stating, for example, that the fund is currently 10% Taxonomy aligned, with the aim of becoming 30% aligned over the next 5 years.

Work is also underway to define the terms of eco-labels, in which a minimum expected percentage of turnover or capital expenditure will have to align to the Taxonomy criteria.

The disclosure regulation is a parallel piece of legislation that will refer to the Taxonomy. The first reporting requirements for investment firms under those rules will start to apply in December 2021, with additional criteria included annually thereafter.

However the Taxonomy will develop over time, with additional testing criteria and the inclusion of further industry sectors. If you would like to find out more about this regulation or how Bloomberg’s data can support a Taxonomy-aligned disclosure, please contact euesg@bloomberg.net