For investors acclimated to working from home, the process of juggling multiple tasks — like traversing a spreadsheet, flipping between windows and managing various data sources — becomes a cumbersome chore rather than a voyage of discovery. Having one tool that manages these routine tasks can free up time for more high-value work.

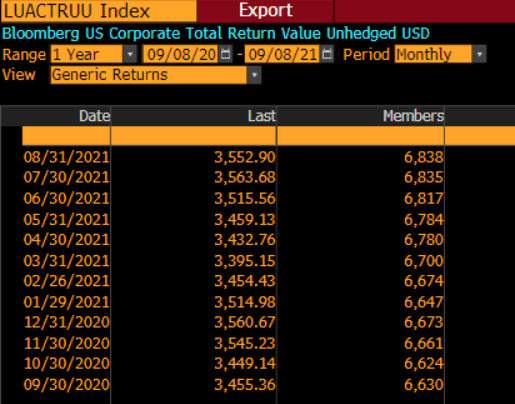

For many, Bloomberg’s technology answers that need. The robust tools offered by Bloomberg can, for instance, enable fixed income desks to discover, analyze and personalize new indices, all with a few keystrokes on the Terminal. Even complex tasks such as determining the composition and rebalancing frequency of an index can be achieved in a fraction of the time. The ability to save time by accessing relevant data in an easy-to-read, consolidated format is more critical than ever.

When markets are in flux, investors need a single all-in-one solution. More platforms, more vendors and more data sources have only created more confusion in recent years. The exponential increase in platforms, vendors and data sources has been an overwhelming challenge for investors.

Bloomberg organizes this chaos of information starting with the Bloomberg Index Browser function: IN <GO>. This tool, available to all Terminal users, provides access to Bloomberg’s full suite of indices, including fixed income, equities, commodities, ESG and more.

Still, investors are constrained by asset classes — some focus on various corners of the world. The Bloomberg Index Browser lets users filter by region, whether they want information about APAC Japan convertibles or traditional U.S. Treasury bonds, for example.

Accessing time series data

Fortunately, Index Insights and Publications, via the Terminal function INP <GO>, aggregates all publications related to Bloomberg Indices. The page details index announcements, technical notes, as well as rule changes that often appear in a fact sheet. In addition, users can find primers and monthly information such as Duration Extensions, Global Family of Indices (GFOI) Reports, Linker Monthly Reports and Return Attribution.