Companies could attract investors by pointing to a better environmental performance than their peers. However, policymakers recognized more had to be done to incentivize investments that align with net zero carbon commitments and the Paris climate agreement.

The EU Taxonomy was designed to solve for this issue. By applying the Taxonomy, investors can determine what investments are considered as contributing towards European environmental objectives, and assess to what degree investment portfolios align with the Taxonomy for their own reporting.

Applying the Taxonomy to assess if investments are aligned with the EU’s environmental objectives requires a careful step-by-step approach. To really take advantage of the benefits of the Taxonomy, a high-quality methodology for all steps is needed. Skandinaviska Enskilda Banken (SEB) and Bloomberg, fellow members of the European Commission’s Platform for Sustainable Finance, developed quantitative approaches and models to assess Taxonomy alignment. We compared and contrasted our approaches and reporting processes to create this step-by-step guide.

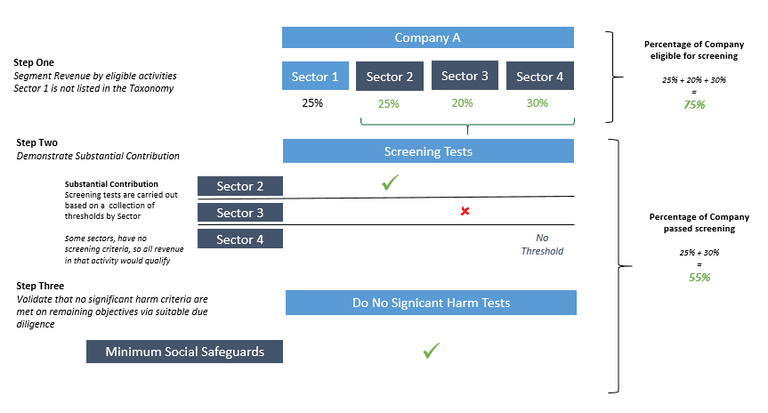

The first step consists in determining if the activities of a company are “eligible”, i.e. covered by the Taxonomy. The European industry classification system (NACE) serves as basis to define economic activities in the Taxonomy. This system can then be translated to any other corresponding classification system, e.g. NAICS or BICS, in order to determine eligible activities. Investors can identify which economic activities a company is involved in by looking at turnover and/or expenditures – capex and, if applicable, opex. Eligible activities then need to be subjected to a series of screening tests, to determine if they are taxonomy-aligned and can be reported as such.

The Taxonomy covers sectors contributing over 93% of Europe’s scope 1 greenhouse gas emissions (direct emissions by a company, see GreenHouse Gas Protocol). Currently, it does not cover certain activities, e.g. in the manufacturing sector. This does not mean that these activities are ‘bad’, and those that are eligible are ‘good’ – it simply means that screening criteria have not yet been developed for ineligible activities.

The Taxonomy regulation will soon require companies/issuers in Europe that are currently subject to the Non-Financial Reporting Directive to provide taxonomy-aligned non-financial reporting. This will allow investors in European listed firms to find, in company reports, not only which activities are eligible but also the percentage of taxonomy-aligned revenue, capex and opex of the company.

However, these reporting requirements will kick in at the same time as investment firms need to start reporting. Until then, investors will need to check if the EU Taxonomy contains screening criteria that can help determine whether the activity in question is aligned or not. Of note, they will need to develop a methodology anyway in order to assess unclassified activities, including international investments that will not fall under the Taxonomy regulation and are therefore not required to report.

The following chart illustrates the 4-step process to determine if an activity is taxonomy-aligned:

As described in the chart above, for each eligible activity, investors need to verify whether the company meets the relevant screening criteria that demonstrate substantial contribution to climate mitigation and/or adaptation objectives. The Taxonomy’s screening criteria are often precise and quantifiable, and it’s not sufficient for a company to claim its revenue is “green” in its sustainability report. Instead, investors need to look at a company’s specific metrics, for e.g. life-cycle greenhouse gas emissions for a certain activity, and assess if it fulfils the criteria set in the Taxonomy.

If we focus on the climate mitigation objective, one example is the technology-agnostic threshold of 100 g CO2e/kWh for electricity generation. To calculate this, investors would need to look at the lifecycle emissions of an energy provider (GHG Scope 1, 2 and 3) per unit of energy generated. This test would apply to any energy provider that engages in power production as described in the Taxonomy. To only check for renewable electricity production is not enough to declare an activity taxonomy-aligned. In case the investor is not able to access the needed data – due to lack of reporting – an estimation of the data point or the approximation of the threshold with help of other reported data could be a solution to determine the significant contribution.

In the context of the Taxonomy, the “do no significant harm” or DNSH criteria, means investors need to conduct a due diligence-type process to verify if these criteria are met by the activity in question. They typically rely on the legal disclosures from investees, and may look to reconcile these with adherence to local environmental regulations.

For example, a car manufacturer would be 100% eligible if all its revenue is from producing cars (under “Manufacture of Low Carbon Technology” in the Taxonomy). If this car manufacturer makes 10% of its revenue from electric vehicles, it can be classified as 10% “potentially aligned” with the Taxonomy as this activity passes the “substantial contribution to mitigation” test described in step 2. To conduct a DNSH test, you would need to verify that those electric vehicles meet the relevant screening criteria in the Taxonomy.

A common misunderstanding is that DNSH tests can be applied at an entity level, or that it is possible to proxy to a low environmental or social rating. In this case, the car manufacturer may fail the test for pollution, due to the petrol and diesel vehicles in their fleet. This would not be the correct application of the test. The Taxonomy is actually asking only for a DNSH assessment against the production process of the electric vehicles in the fleet, such that they are not harming any other environmental objective either during the production process or in the use phase and end of life treatment of the vehicles. If those vehicles meet the substantial contribution criteria and demonstrate DNSH to the remaining five environmental objectives, then the revenue made from those vehicles can be counted as taxonomy-aligned.

Source: Taxonomy Report, European Commission

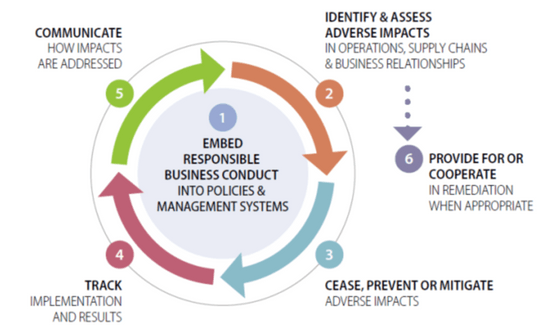

At this point in the process, investors need to conduct due diligence to avoid any negative impacts on the minimum safeguards stipulated in the Taxonomy Regulation, with reference to OECD guidelines, UN Guiding Principles on Business and Human Rights and Labour Rights conventions. Issuers are expected to conform with the eight ILO conventions, and should make their human rights and anti-corruption policies available via their sustainability reports. One obstacle here is non-reporting, and establishing whether the lack of disclosure of such a policy indicates the company is non-compliant.

Source: Taxonomy Report, European Commission

Depending on the product type, investors have two main options. They can determine whether the asset’s use of proceeds go towards a taxonomy-eligible project. If the answer is yes, the taxonomy-aligned percentage of that project is the taxonomy-aligned percentage of the asset and subsequently the percentage is applied to the investment holding in a portfolio. If a qualifying green debt instrument is 50% taxonomy aligned, then this asset would count as a 50% portfolio weighted score to the overall investment.

If not, the other option is to segment the revenue of the issuer, or parent entity, by activities and determine which ones are aligned. Once investors understand how portfolios align with these activities, they can determine how much of their portfolio is taxonomy-eligible and subsequently taxonomy-aligned. For example, if 18% of a fund is invested in a company that makes 10% of its revenue from Taxonomy-aligned activities, the fund is 1.8% taxonomy-aligned for that investment, and so on (see chart below).

The disclosure obligations in the Taxonomy Regulation apply to anyone offering financial products in the EU, regardless of where the manufacturer of such products is based. This should lead to increased interest from international investors in disclosing their taxonomy-alignment. International corporates may in turn wish to attract investors by claiming taxonomy-aligned substantial contribution to environmental objectives.

It is therefore likely that the EU Taxonomy will influence international reporting frameworks over time. The EU has created an International Platform on Sustainable Finance (IPSF), which will encourage coordination on the development and harmonization of taxonomies between its members.