In these times of turbulence, identifying signs of distress that may impact a borrower’s capacity to repay debt, or a customer or supplier’s capacity to meet its obligations, has proven critical. As the economic downturn continues, the importance of understanding credit risk will only increase.

Firms that evaluate credit on a periodic or quarterly basis have found themselves particularly exposed, if only by the sheer speed and scale of the changes. Between January and April 2020, a company might have gone from looking ‘healthy’ to being distressed or even declaring bankruptcy. There are no such things as bad loans, only loans that go bad, as the old adage goes. Keeping abreast of credit risk developments in times of volatility is a key challenge for all traders, front-office staff and risk managers.

With central banks supporting markets by purchasing specific securities, evaluating credit risk runs into an extra level of complication. The moral hazard is apparent – once the US Federal Reserve checks in, can it ever really check out? And, if it does, what could happen to credit? What do these vast and determined purchasing schemes mean for market structure?

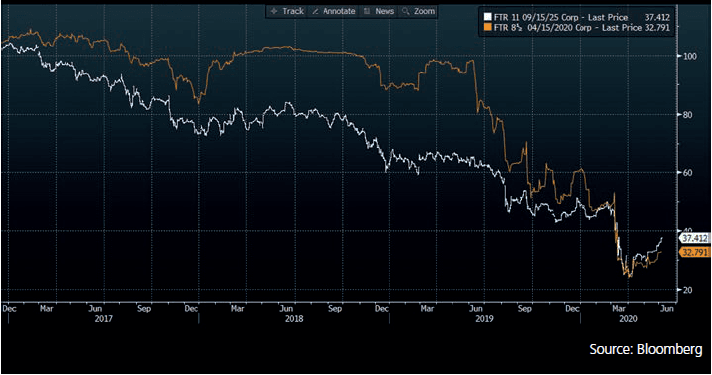

Price does not always indicate risk. Frontier Telecommunications, for example, filed for bankruptcy in April 2020. Bloomberg’s analytics flagged a rise of default risk beginning as early as 2017, but the bonds did not deteriorate substantially until 2019.

Figure 1 highlights how Frontier bonds responded to the firm’s crumbling credit condition.

Firms need to understand the borrower’s ability to pay as well as the externalities that may impact it.

1. Frontier filed: Warnings of Frontier Telecommunications’ bankruptcy were flagged long before April 2020. Click image to expand.

COVID‑19 has shown a need to identify credit risk early on – to see around corners, so to speak – to keep abreast of changes and make informed decisions before the worst happens.

The first task is identifying credit risk. Questions that firms need to ask themselves include: What is the risk of default? In the event of a default, how much can the investor expect to recover? How long could that take?

Then there could be factors such as correlation risk. If a bank lends to a coal mining company, it will need to understand the general state of affairs in the coal mining industry. Technological change is also a consideration as new solutions – such as alternative energy – disrupt old business models.

Pricing, as previously mentioned, should never be the sole measure of risk. Another measure is performance. Is a company paying its bills on time? Beyond this, what is the probability of default? The ability to calculate probabilities of default regularly and dynamically in near real time is crucial for risk assessment – especially in times of COVID-19 and economic volatility.

As for monitoring credit risk, comparability is a useful assessment measure. Comparing credit default swap (CDS) spreads, for example, may be a good place to start, if prices are available and executable.