Replacing LIBOR with alternative rates

Banks’ conduct risk may rise exponentially when replacing LIBOR with an alternative rate in contracts and products — regulators will keep a close eye to ensure they’re treating customers fairly. Failure will expose them to regulatory fines and litigation. Critically, they must be cautious not to move customers to higher rates than LIBOR would have been or otherwise introduce inferior terms. They will also need to communicate clearly with all customers in good time to allow them to consider options and make informed decisions by 2022 (or July 1, 2023 for dollar-denominated LIBOR).

Some 4.52 billion pounds of floating-rate notes linked to GBP LIBOR maturing from 2022 exist across 92 issues from Jan. 1, 2022 and $213.3 billion linked to dollar LIBOR across 1,133 issues from July 1, 2023, according to April 19 Bloomberg data.

Asset managers face being on the hook

Asset managers face significant conduct risk as they move away from LIBOR, which we believe poses a serious threat, given the industry is built upon trust, with reputational tarnish possibly triggering fund outflows. A smooth change looks tricky due to portfolios’ widespread use of LIBOR as a fund benchmark or performance target (which must be transitioned without inflating performance) and as an input for valuation, risk and pricing models. Managers have just more than a year to engage with issuers to convert products to alternative rates through consent solicitation or bond buybacks.

BlackRock, M&G, Schroders, Standard Life Aberdeen and Invesco hold the most British-pound LIBOR-linked floating-rate loan notes maturing after 2022, based on available Bloomberg data, while Lyxor and Wellington appear among the least exposed.

Source: Investment Association, Bloomberg Intelligence

Transition slow in Europe, slower in Asia

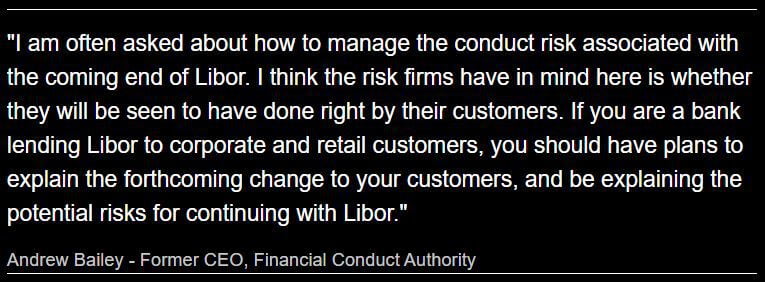

While Covid-19 may have thrown LIBOR-transition plans off course, the Financial Conduct Authority still expects companies to have a clear plan of action with distinct deadlines. This goes to the heart of good governance — select board members and senior managers are on the hook, personally accountable under the new SM&CR rule for managing transition risk. Meanwhile, though banks in Europe and the U.S. are short of time, they appear better prepared than their peers in Asia, chiefly due to varying degrees of regulatory guidance.

General Electric, Lloyds, Energy Transfer and Goldman Sachs have issued the most floating-rate loan notes linked to dollar LIBOR maturing from July 1, 2023, and Aviva, TVL Finance, Premier Foods and Generali linked to sterling LIBOR maturing from Jan. 1, 2022, based on available Bloomberg data.

View entire statement at: https://www.fca.org.uk/news/speeches/libor-preparing-end

LIBOR to RFR isn’t a straightforward switch

RFRs such as SOFR, SONIA (Sterling Overnight Interbank Average Rate) and ESTR (Euro Short-Term Rate) are structurally different to LIBOR, which is what makes the transition tricky. LIBOR is forward-looking, quoted for five currencies across seven tenors and with the linked interest-rate payable known at the start of the interest period. RFRs are overnight rates published the next day. A three-month rate, for example, can’t be calculated in the same way. LIBOR also builds in credit risk, as it represents the average cost of bank borrowing — this isn’t incorporated into an RFR.

Nine ESTR-linked bonds and 106,980 loans are in issue, according to Bloomberg data, with Credit Agricole, Deutsche Bank, Standard Chartered Bank and UniCredit topping the Bloomberg manager league table, in that order, with equal 25% market share.