The idea was that contributors would step away, and the market would be forced to find another benchmark. But so far there’s not much unity: The U.S. created a would-be replacement, the secured overnight funding rate (SOFR), and the Bank of England is touting the sterling overnight index average (Sonia). The European Union has been a bit more meandering, but a new rate that launched on October 1, 2019 — the euro short-term rate (ESTR) — apparently will be the focus there.

Of course, when it comes to derivatives, the devil always lurks in the details. In a traditional LIBOR coupon in a swap, fixing occurs at the beginning of the period, so the size of the cash flow for the payment at the end of the period is known well in advance. But for swaps based on these new overnight rates, the coupon is calculated by daily compounding of the underlying rate. As a result, the final rate for the payment is not known until the day before it’s due.

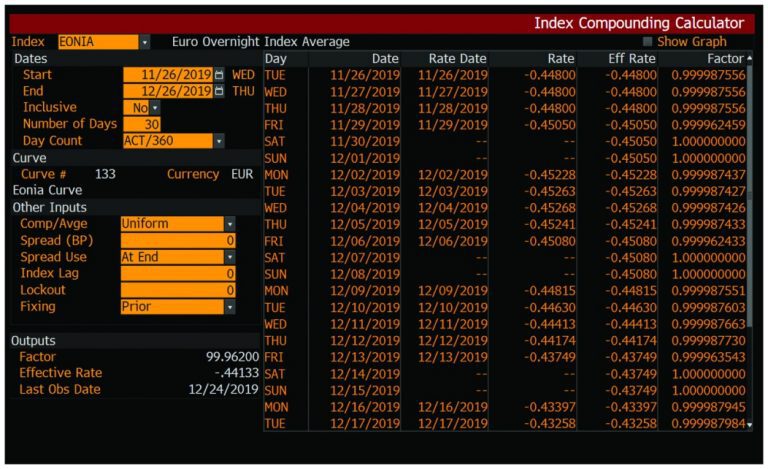

Go to EONC for the Index Compounding Calculator