Firms that evaluate credit on a periodic or quarterly basis have found themselves particularly exposed, if only by the sheer speed and scale of the changes. Between January and April 2020, a company might have gone from looking “healthy” to being distressed or even declaring bankruptcy. There are no such things as bad loans, only loans that go bad, as the old adage goes. Keeping abreast of credit risk developments in times of volatility is a key challenge for all traders, front-office staff and risk managers.

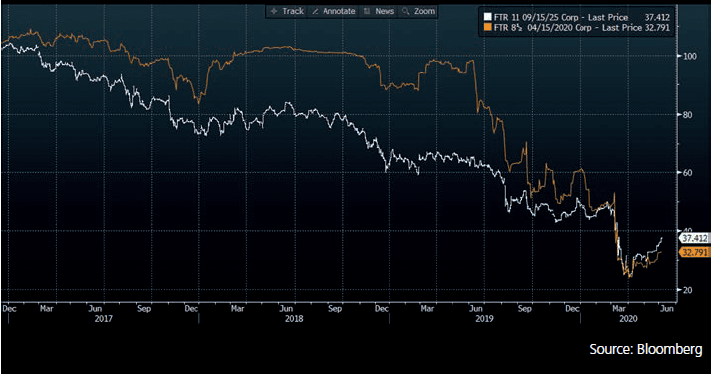

1. Frontier filed: Warnings of Frontier Telecommunications’ bankruptcy were flagged long before April 2020

Credit ratings data from the major credit ratings agencies continues to be a reliable measure of creditworthiness and a standard benchmark for credit quality; however, since the 2008 financial and mortgage bond crisis, there remains an active debate around how firms should rely on and use credit ratings data within their credit risk management frameworks. Like prior crises, the market is once again left looking for leading indicators to proactively manage credit risk and capitalize on investment opportunities, including bank lending. COVID-19 has once again proven that the market reacts to events in real time while many risk measures lag the market, which makes market-derived risk measures an essential component of any credit risk framework.