The large-scale and complex nature of climate change makes it uniquely challenging, especially in the context of economic decision making. Further, many companies have incorrectly viewed the implications of climate change to be relevant only in the long term and, therefore, not necessarily relevant to decisions made today. Those views, however, are changing as more information becomes available on the potential widespread financial impacts of climate change.

In December 2019, Bank of England Governor Mark Carney noted that “Changes in climate policies, new technologies and growing physical risks will prompt reassessments of the values of virtually every financial asset.” Companies and providers of capital, therefore, should consider their longer-term strategies and most efficient allocation of capital in light of these changes. Organizations that invest in activities that may not be viable in the longer term will likely be less resilient to the transition to a lower-carbon economy — and their investors will likely experience lower returns.

Compounding the effect on longer-term returns is the risk that present valuations do not adequately factor in climate-related risks because of insufficient information. Investors, lenders and insurance underwriters need adequate information on how companies are preparing for a lower-carbon economy. More effective, clear and consistent climate-related disclosure is needed from companies around the world.

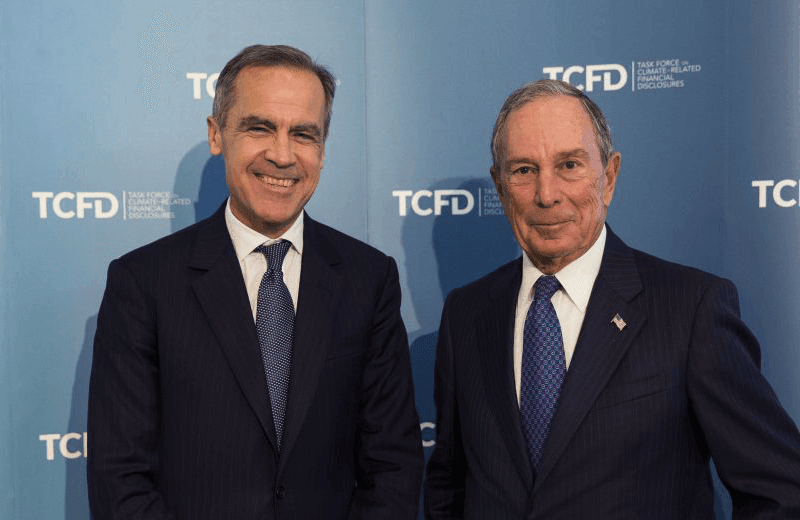

Mark Carney, UN Special Envoy on Climate Action and Finance and Michael R. Bloomberg, TCFD Chair