In its work, the Task Force drew on member expertise, significant stakeholder engagement and existing climate-related disclosure regimes to develop a singular, accessible framework for climate-related financial disclosure. The recommendations are structured around four thematic areas that represent core elements of how organizations operate: governance, strategy, risk management and metrics and targets.

The four overarching recommendations are supported by 11 key climate-related financial disclosures — referred to as recommended disclosures — that build out the framework with information that will help investors and others understand how reporting organizations assess climate-related issues.

Managing climate-related issues

Building appropriate internal processes to manage climate-related issues as well as collecting necessary data and metrics.

Existing and future reporting requirements

Reviewing requirements for financial and non-financial reporting; considering whether additional requirements will likely be released.

Reporting capabilities

Developing processes and capacity to report information under the TCFD recommendations — subject to appropriate internal governance processes and in line with regulatory requirements.

Materiality

Taking the unique longer-term impacts and challenges of climate change into account when assessing materiality. All organizations are encouraged to report in line with the Governance and Risk Management recommendations regardless of materiality.

Placement

Determining the appropriate placement of disclosures — in mainstream (i.e., public) annual financial filings as recommended by the TCFD or other official company reports.

Ongoing collaboration and improvement

Organizations have expressed that participation in TCFD working groups, workshops or even knowledge sharing with peers and investors has been helpful in advancing climate-related disclosure.

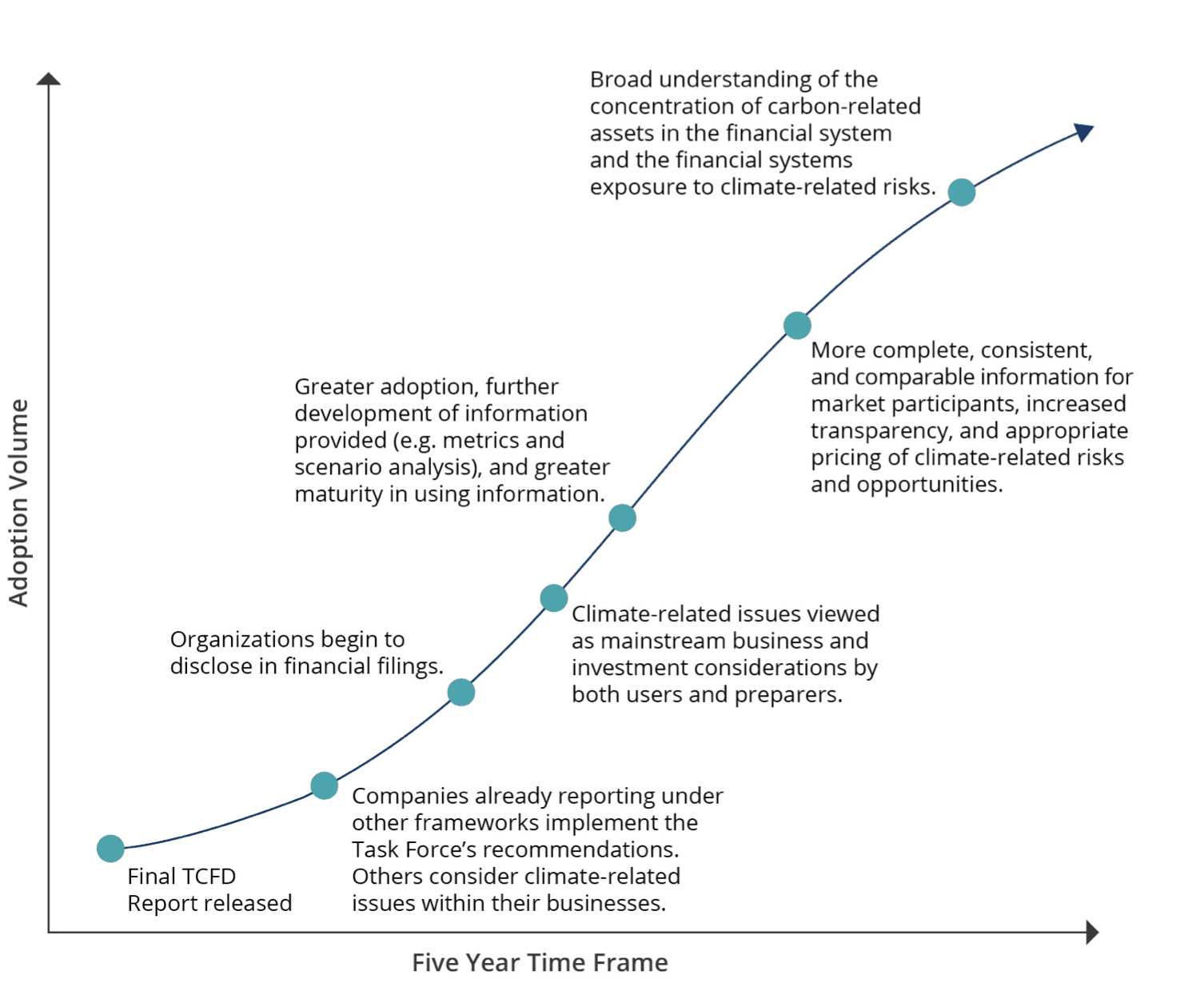

Illustrative Implementation Path